For most Arizona small business owners, a lease is the largest financial obligation outside of payroll — yet it’s often signed with less scrutiny than a vendor contract.Commercial leases are not designed to be “fair.”They are designed to protect the property owner first.This guide will walk you through:The most common hidden risks in Arizona commercial leasesThe financial traps that quietly destroy...

Small Business

At some point, nearly every successful Arizona business owner reaches a strategic crossroads:Do I keep leasing… or is it time to own my real estate and scale differently?This decision affects far more than rent. It influences:Your long-term cash flowYour tax strategyYour balance sheetYour business valuationYour personal retirement timelineAnd your ability to expand intelligentlyThis guide breaks down:The...

Every small business owner in Arizona eventually experiences it:slow seasons, customer demand shifts, unexpected economic tightening, or rising operating costs that compress margins.While most owners focus on cutting expenses or increasing marketing during downturns, the most financially resilient entrepreneurs do something different — they build real estate into their business strategy to stabilize cash...

Opening a brick-and-mortar location is one of the most exciting milestones for a small business owner—but it’s also one of the most expensive and complex. Whether you’re launching a boutique, café, salon, service business, or professional office, understanding the true full cost of opening a physical location in the Phoenix metro can make the difference between a confident launch and a stressful...

**A Practical Sizing Guide for Arizona Small Business Owners**Choosing the right amount of commercial space is one of the most common (and most expensive) decisions Arizona small business owners face. Lease too much, and you’re paying for square footage you don’t actually need. Lease too little, and you’re cramped, inefficient, or forced into an early move—often years before your business is...

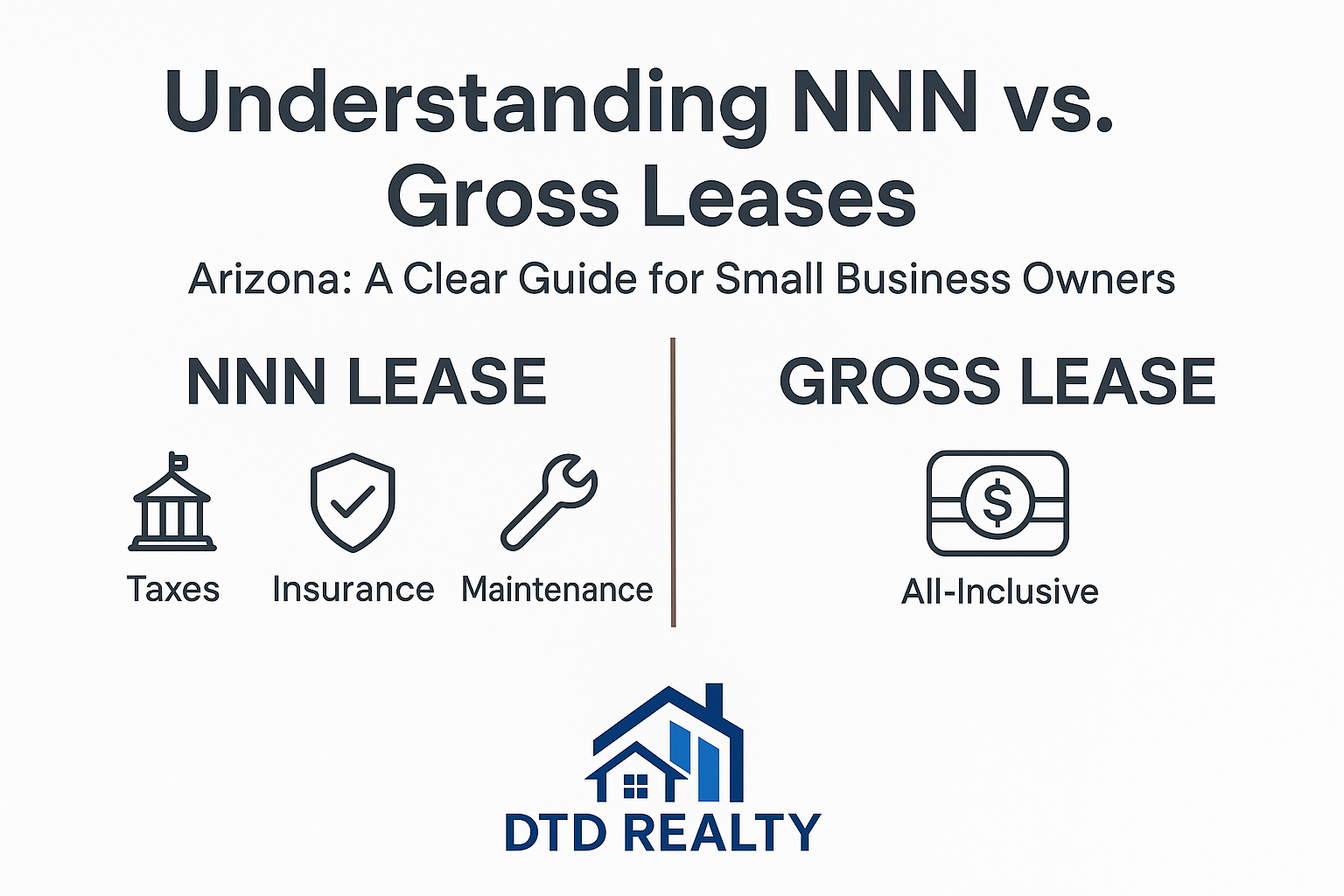

Choosing the right commercial lease can make or break a small business—especially in Arizona, where operating costs, property taxes, insurance, and landlord expectations vary widely between submarkets. Whether you’re opening your first brick-and-mortar location or expanding into a second site, understanding the structure of your lease is one of the most important financial decisions you’ll...

Choosing the right location is one of the most important strategic decisions a small business owner can make. In the Phoenix metro—one of the fastest-growing regions in the country—the “best” submarket depends entirely on your business model, customer base, and budget.This guide breaks down the most business-friendly areas across the Valley for retail, office, and live/work users. Whether you're...

If you’re a real estate investor, you’ve likely heard about how cost segregation unlocks massive tax deductions by reclassifying parts of your property into faster-depreciating components. But with the passage of the One Big Beautiful Bill Act (OBBBA), some of the long-standing rules have changed — and the timing of when you do your cost segregation study (or acquire property) could materially affect...

Arizona small business retirement real estate is one of the most powerful — and most underutilized — wealth-building tools available to business owners today. While many entrepreneurs pour all their energy into growing revenue, far fewer take time to build real estate assets that stabilize income, reduce taxes, and support long-term retirement security. In this guide, we break down how Arizona business...

By DTD Realty — Arizona Commercial and Investment Brokerage Small commercial properties—office condos, retail bays, light industrial suites, mixed-use units—sell faster and for more money when properly prepared. But preparation does not mean pouring money into renovations you’ll never get back. In today’s Arizona market, smart owners focus on strategic improvements, strong financial...