Arizona investors love quick rules of thumb—and for good reason. When you’re screening dozens of potential rental properties, simple benchmarks help you separate “worth a deeper look” from “don’t waste time.”Two of the most popular rules are the 1% Rule and the 0.7% Rule.But here’s the catch: Arizona’s market is wildly different from the Midwest markets where these rules originally took...

Investor Basics

Analyzing a rental property doesn’t need to be overwhelming—especially when you follow a clear, repeatable process. Whether you’re evaluating a condo in Mesa, a single-family rental in Phoenix, or a duplex in Tucson, the fundamentals stay the same.This guide breaks down exactly how to analyze a rental property step-by-step, using simple examples and Arizona-focused insights so beginning investors can...

If you use financing to purchase investment property—and most Arizona investors do—then cash-on-cash return (CoC) is one of the most important metrics you’ll ever learn. It tells you how hard your actual invested dollars are working for you each year.If cap rate is the “big picture,” cash-on-cash is the real-world return on the money you actually put in.This guide breaks it down in simple terms,...

For most real estate investors—especially beginners—cash flow is the metric that matters most. It’s the money that hits your bank account every month after paying all the bills. In a rising-cost environment like Arizona (insurance, taxes, and HOA fees all trending upward), knowing how to correctly calculate cash flow has never been more important.This guide will walk you through what cash flow really...

If you’re getting started in real estate investing, you’ve probably heard the term cap rate thrown around a lot. It’s one of the simplest—but most misunderstood—metrics in the industry.And for Arizona investors, understanding cap rates can help you quickly compare rentals in Phoenix, Mesa, Tucson, and fast-growing areas like Queen Creek, Buckeye, and Maricopa.This guide breaks cap rates down in a...

A 1031 Exchange is one of the most powerful tax-deferral tools available to real estate investors. For new (and even experienced) Arizona investors, understanding how a 1031 works can be the difference between slow growth and compounding long-term wealth.This guide breaks down the essentials in a warm, straightforward, Arizona-specific way—without unnecessary jargon. What Is a 1031 Exchange?...

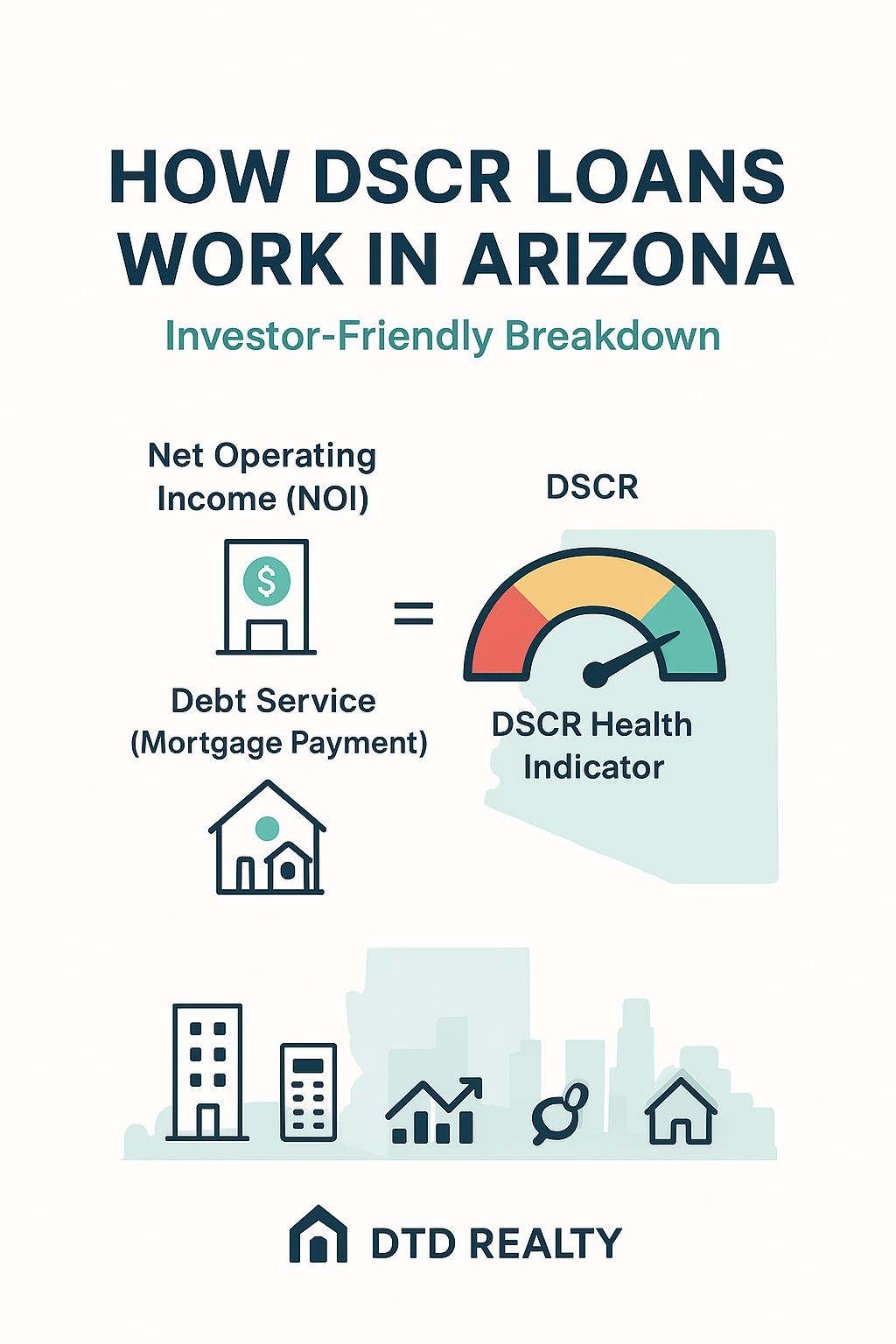

If you’re a newer investor looking to scale in Arizona, the term DSCR loan will come up almost immediately. These loans have exploded in popularity because they allow investors to qualify based on the property’s income, not their personal tax returns.For investors with self-employment income, multiple rental properties, or complex write-offs, DSCR financing can be a game-changer. They aren’t perfect,...

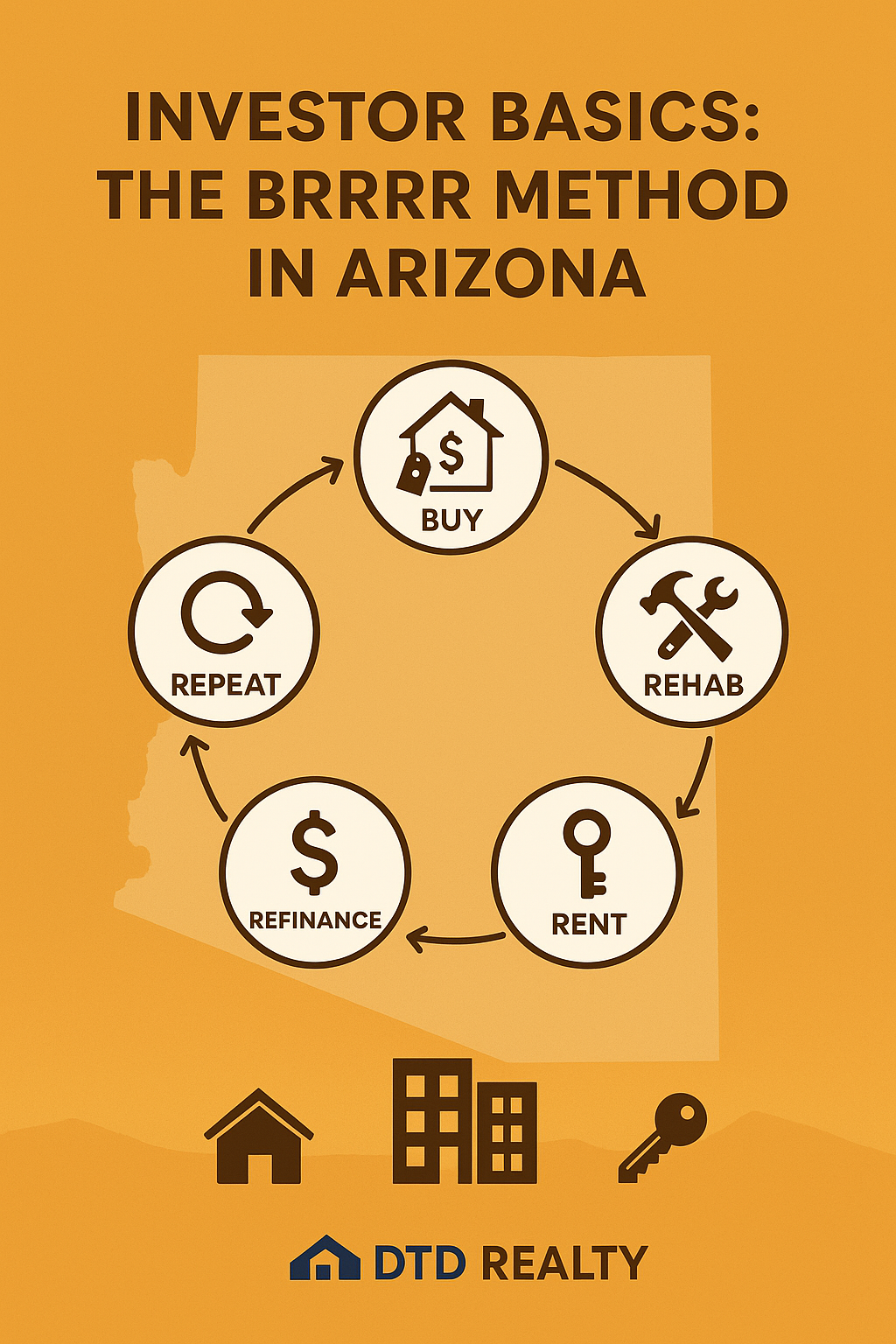

If you talk to any seasoned real estate investor in Arizona, eventually you’ll hear the acronym BRRRR. It stands for Buy, Rehab, Rent, Refinance, Repeat, and it’s one of the most popular strategies for accelerating portfolio growth—especially for investors who don’t have endless capital to deploy.BRRRR is powerful because it transforms a single down payment into multiple properties over time....

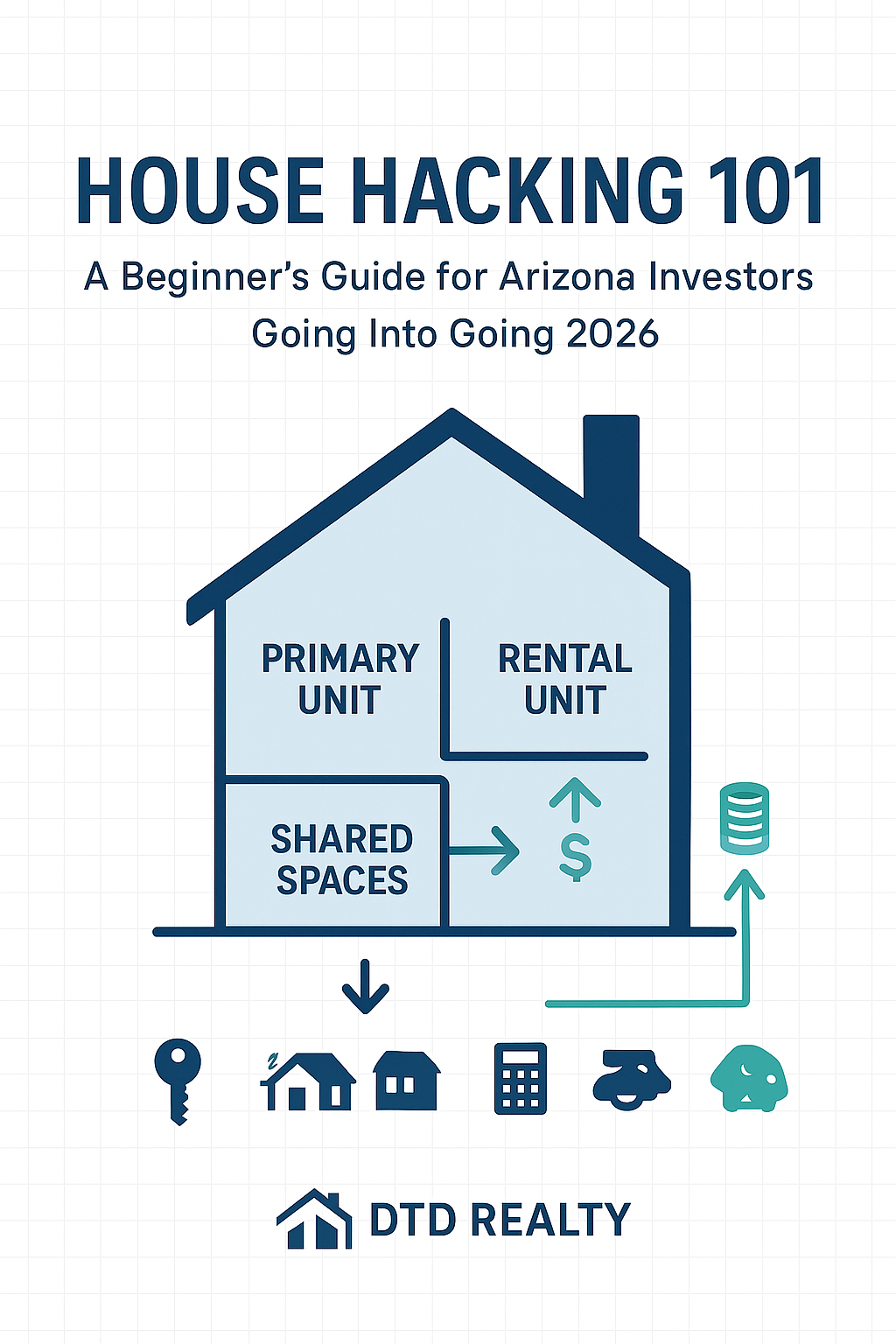

For new investors, house hacking is one of the simplest, safest, and smartest ways to build wealth through real estate. It’s the strategy that has launched thousands of investor careers nationwide—and it works especially well in Arizona, where rising rents, strong job growth, and a flexible lending environment create ideal conditions for beginner investors.This guide breaks down what house hacking is,...

Once you own a few rental properties, the game changes.You’re no longer asking “How do I buy my first investment?” — you’re asking:“What should my long-term portfolio look like?”“Should I stay focused, or diversify?”“What mix of cash flow and appreciation will get me to retirement?”“Which Arizona sub-markets should I expand into?”This is where portfolio strategy becomes just as...