Analyzing a rental property doesn’t need to be overwhelming—especially when you follow a clear, repeatable process. Whether you’re evaluating a condo in Mesa, a single-family rental in Phoenix, or a duplex in Tucson, the fundamentals stay the same.

This guide breaks down exactly how to analyze a rental property step-by-step, using simple examples and Arizona-focused insights so beginning investors can learn the right way—without getting lost in spreadsheets.

1. Start With the 60-Second “Quick Screen”

Before you do a deep dive, confirm the property might work.

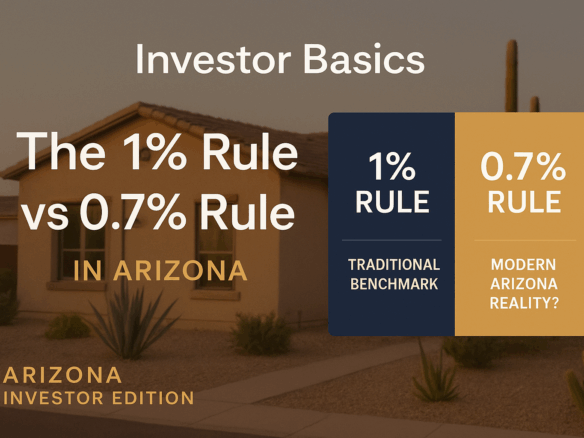

A. Price-to-Rent Ratio (Gross Rent Multiplier Test)

For Arizona SFRs, you generally want:

Monthly Rent ≈ 0.7%–1% of purchase price (SFRs)

Monthly Rent ≈ 1%–1.3% (multifamily)

Example

$400,000 Phoenix home → should rent for at least $2,800–$4,000/mo

If rents are $1,900? Probably not a strong rental candidate.

B. Location Quick Check

Confirm fundamentals:

- Job access

- Demand drivers (ASU, Banner Health, Amazon, military bases)

- Rent comps show low vacancy

- Area supports stable rent growth

If the property passes the quick screen → proceed.

2. Determine Realistic Rent

Use:

- Active comps (asking rents)

- Leased comps (actual signed rents)

- Adjustments for condition, renovations, yard, pool, beds/baths, parking, appliances, pets

Arizona Tip

Phoenix and Mesa rents can swing $200–$400 for small differences in upgrades or HOA amenities. Tucson rents swing less, but occupancy is extremely stable.

Rule of Thumb

Always use conservative rent estimates, not the highest comp.

3. Estimate All Operating Expenses

Many beginners underestimate this part. Arizona investors should use the following:

Core Operating Expenses

| Category | Approx % / Notes |

|---|---|

| Property Taxes | Varies by city; AZ taxes can rise fast after reassessment |

| Insurance | Arizona premiums rose 20–40%+ recently |

| HOA Fees | Common in Phoenix-area condos & townhomes |

| Property Management | 8–10% typical |

| Maintenance | 8–10% of rents |

| CapEx Reserve | 5–10% of rents |

Arizona-Specific Notes

- Insurance keeps climbing—budget realistically.

- Pools add value but require higher maintenance reserve.

- Older homes (1950s–1980s) = higher CapEx risk (electrical, plumbing, A/C).

4. Calculate Your Monthly Cash Flow

Use the formula:

Cash Flow = Rent – Operating Expenses – Mortgage Payment

Example: Tempe Townhome

- Rent: $2,200

- Total expenses (incl. HOA + mgmt + reserves): $1,850

- Mortgage: $1,450

Cash Flow = 2200 – 1850 – 1450

= –$1,100 (negative)

This would immediately be rejected—cash flow matters before moving forward.

Now compare to…

Example: East Mesa SFR

- Rent: $2,400

- Total expenses: $1,950

- Mortgage: $1,300

Cash Flow = 2400 – 1950 – 1300

= –$850 (also negative)

(This one is negative because we’re assuming 20% down. With 30% down or a better rate, it may cash flow positive.)

This stage helps investors eliminate weak deals early.

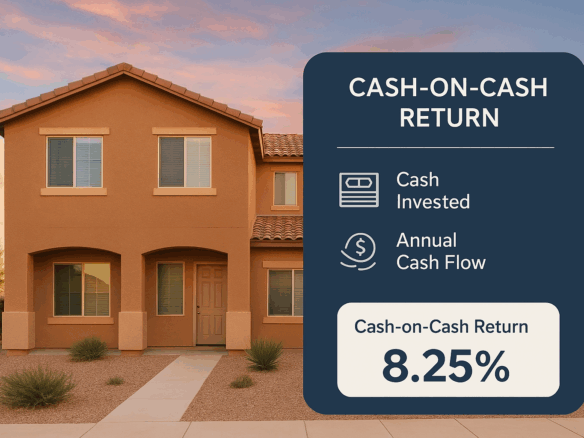

5. Calculate Cash-on-Cash Return (CoC)

CoC is the #1 beginner metric because it shows how hard your initial cash is working.

Formula

Cash-on-Cash Return =

Annual Cash Flow ÷ Total Cash Invested

Your Total Cash Invested =

Down Payment + Closing Costs + Initial Repairs + Loan Fees

Clear Arizona Example

Property: 3-bed in Laveen

Total cash in: $62,000

Annual cash flow: $2,700

CoC = 2700 / 62000 = 4.35%

Even if cash flow is only $225/mo, a 4.35% CoC in a strong appreciation market like Phoenix is often a solid long-term play for beginners.

6. Check the Cap Rate

Cap Rate tells you how well the property performs without financing.

Formula

Cap Rate =

NOI ÷ Purchase Price

Where:

NOI = Rental Income – Operating Expenses (before mortgage)

Arizona Benchmarks (2025)

- SFR: 4–5%

- Duplex/Triplex: 5–6%

- 4–10 unit: 5.5–7%

- Tucson small multis: often 6–7.5%

Cap Rate helps you compare one Arizona deal to another—regardless of financing.

7. Evaluate Appreciation & Demand Trends

Cash flow is only half the story—especially in Arizona.

Long-term drivers supporting appreciation:

- Population growth corridors (Queen Creek, Buckeye, Maricopa)

- Job corridors (Intel, Northrop Grumman, TSMC, Banner, ASU)

- New highways + infrastructure

- Housing supply shortage across Phoenix metro

Investors should look for 3–5% appreciation potential, not speculation.

8. Stress-Test the Deal

Ask:

- What if rent drops 5%?

- What if insurance increases (again)?

- What if vacancy hits 2 months?

- Can I still hold this property?

A good deal survives these tests.

9. Build Your Exit Strategy

Every rental should have at least one of these:

- Long-term hold (primary strategy for most AZ investors)

- Cash-out refinance after equity build

- 1031 exchange

- Sell to owner-occupant (often yields top dollar)

Knowing how you plan to exit affects how you analyze the property today.

10. Make Your Decision

By the time you complete all steps:

You’ll know if the property is…

- Cash flow positive (or close to it)

- A strong CoC return

- A reasonable cap rate

- In a growth corridor

- Able to withstand surprises

- Fit for your strategy

Most importantly—you’ve avoided emotional decision-making.

Final Thoughts

Successful investing in Arizona is not about finding “perfect” deals. It’s about:

- Consistent buying

- Strong fundamentals

- Conservative underwriting

- Long-term vision

If you follow this step-by-step approach, you’ll make smart, repeatable decisions—whether you’re analyzing your first condo or your fifth small multifamily property.

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.

📞 602.702.3601

🌐 https://www.dtdrealty.com

📩 [email protected]