If you’re getting started in real estate investing, you’ve probably heard the term cap rate thrown around a lot. It’s one of the simplest—but most misunderstood—metrics in the industry.

And for Arizona investors, understanding cap rates can help you quickly compare rentals in Phoenix, Mesa, Tucson, and fast-growing areas like Queen Creek, Buckeye, and Maricopa.

This guide breaks cap rates down in a clean, practical way—zero jargon, beginner friendly.

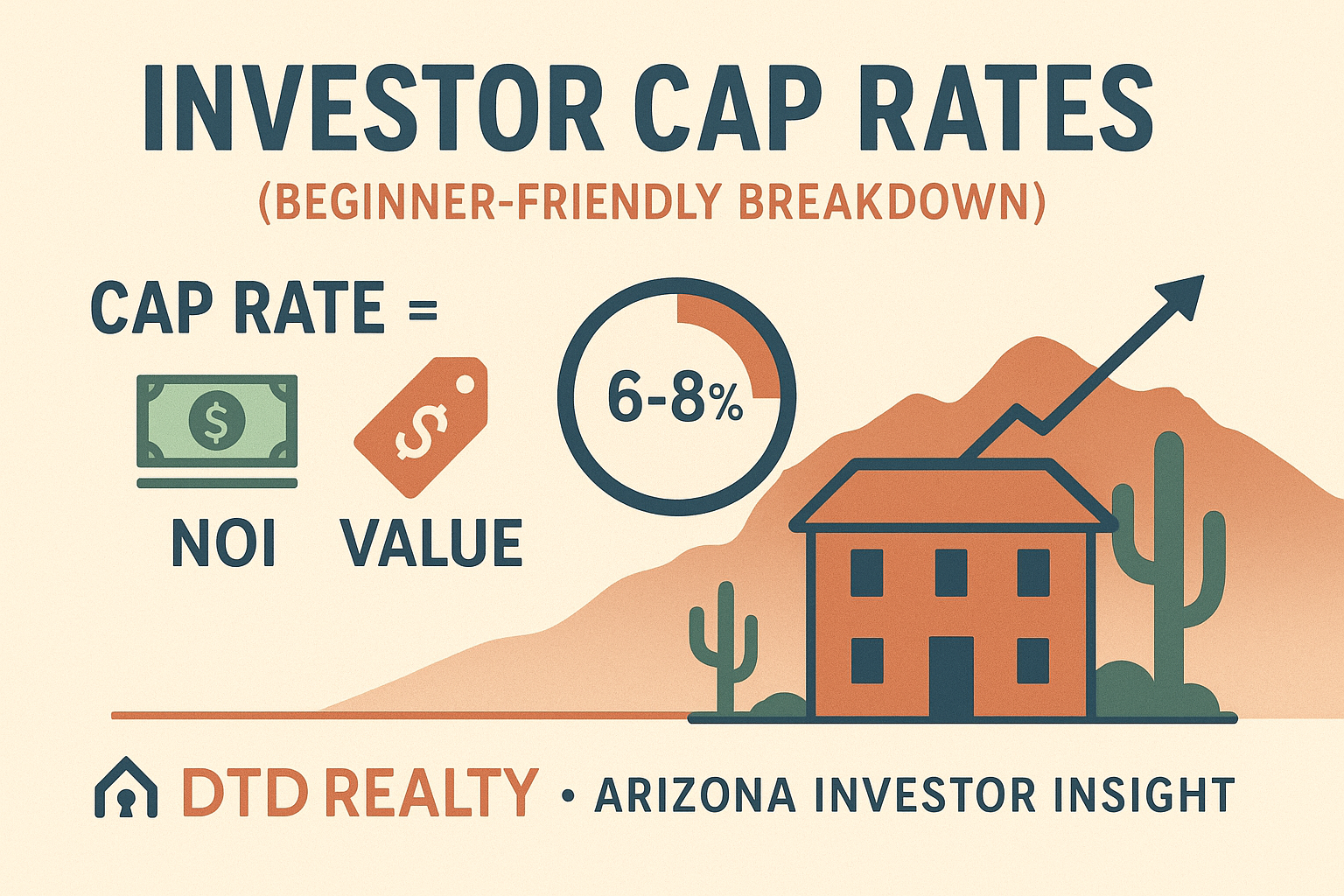

What Is a Cap Rate? (Simple Definition)

A cap rate—short for capitalization rate—is a quick snapshot of an investment property’s expected return if you bought it in all cash.

It is calculated with one formula:

Cap Rate = Net Operating Income (NOI) ÷ Purchase Price

Where NOI =

Gross Rents – Operating Expenses (taxes, insurance, maintenance, management, utilities you pay, HOA, etc.)

Does NOT include mortgage payments.

Cap rate is basically:

“How hard is this property working for me if I paid cash?”

Why Cap Rate Matters for Arizona Investors

1. Fast Comparison Between Properties

Cap rate helps you compare:

- a rental in Phoenix vs. one in Tucson

- a Tempe condo vs. a Buckeye single-family house

- an older home in Glendale vs. a new build in Maricopa

It levels the playing field.

2. Helps Identify Overpriced or Underperforming Properties

If a property has a very low cap rate compared to the local average, something is off:

- rents too low

- taxes/insurance too high

- or the price is inflated

3. Helps Project Future Returns

Cap rate isn’t the whole story, but it’s a great starting point before diving deeper into cash flow, appreciation, tax benefits, long-term hold strategy, and Arizona-specific trends.

Typical Cap Rates in Arizona (2025 Ranges)

These are general ranges—not rules. Neighborhoods, property type, age, and condition matter.

Phoenix Metro (SFR Rentals):

- 4–6% cap rate is common

- Newer builds often closer to 4%

- Older homes closer to 6%

Tucson Metro:

- 5–7% common

- Some duplexes/fourplexes stretch higher

Flagstaff & Sedona Area:

- 3–5% typical due to high prices

- Lower cap rates, higher appreciation plays

Small-Multi (Duplex–Fourplex) in Phoenix & Glendale:

5–7% depending on rents, condition, and era

Commercial / NNN:

5–7% depending on tenant and lease structure

Cap rates are only a snapshot, but they help beginners understand whether a deal falls in a normal Arizona range.

What Cap Rate Does Not Tell You

A big mistake beginners make is thinking cap rate tells the whole story.

It doesn’t.

Cap rate does NOT show:

- Cash flow after financing

- Appreciation potential

- Tax benefits (depreciation)

- Rental demand strength

- Vacancy trends

- Renovation costs

- Long-term rent growth

- HOA restrictions or STR/long-term limits

This is why in DTD Realty’s investor analysis, cap rate is only one metric, not the decision-maker.

Cap Rate Example: Arizona Single-Family Rental

Let’s say you’re analyzing a home in Surprise, AZ.

Gross Annual Rent:

$2,200/month = $26,400/year

Operating Expenses:

- Taxes: $1,900

- Insurance: $1,300

- Management: $2,112

- Maintenance Reserve: $1,500

- HOA: $600

- Other misc: $500

Total Expenses: $7,912

NOI:

$26,400 – $7,912 = $18,488

Purchase Price:

$380,000

Cap Rate:

$18,488 ÷ $380,000 = 4.86%

This falls right in line with Phoenix-area expectations.

Cap Rate vs. Cash-on-Cash Return (Don’t Confuse Them)

Cap rate = assumes all-cash purchase

Cash-on-cash return = includes your loan, down payment, and financing costs

Two different metrics with two very different purposes.

Arizona investors who use financing typically rely on:

- cash-on-cash return

- DSCR

- 10-year cash flow projections

- exit strategy ROI

Cap rate is the starting point—not the final decision.

When Higher Cap Rates Are Not Better

A high cap rate can signal:

- weaker neighborhoods

- older systems

- higher crime pockets

- slower rent growth

- higher turnover

- higher repair and capital expense risk

A “too good to be true” cap rate often comes with hidden headaches.

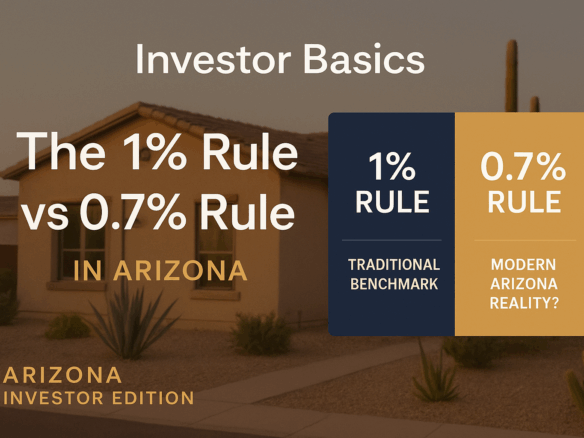

What’s a Good Cap Rate in Arizona?

There is no universal “good.”

Instead ask:

Does the cap rate match the risk, market, and my long-term strategy?

In general:

- Low cap rate = stronger appreciation, better neighborhoods

- High cap rate = more cash flow, more risk

Your goals determine which is better.

If you want help building a balanced Arizona portfolio with both appreciation and cash flow plays, that’s exactly what we do at DTD Realty.

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.

📞 602.702.3601

🌐 https://www.dtdrealty.com

📩 [email protected]