If you’re a newer investor looking to scale in Arizona, the term DSCR loan will come up almost immediately. These loans have exploded in popularity because they allow investors to qualify based on the property’s income, not their personal tax returns.For investors with self-employment income, multiple rental properties, or complex write-offs, DSCR financing can be a game-changer. They aren’t perfect,...

Financing

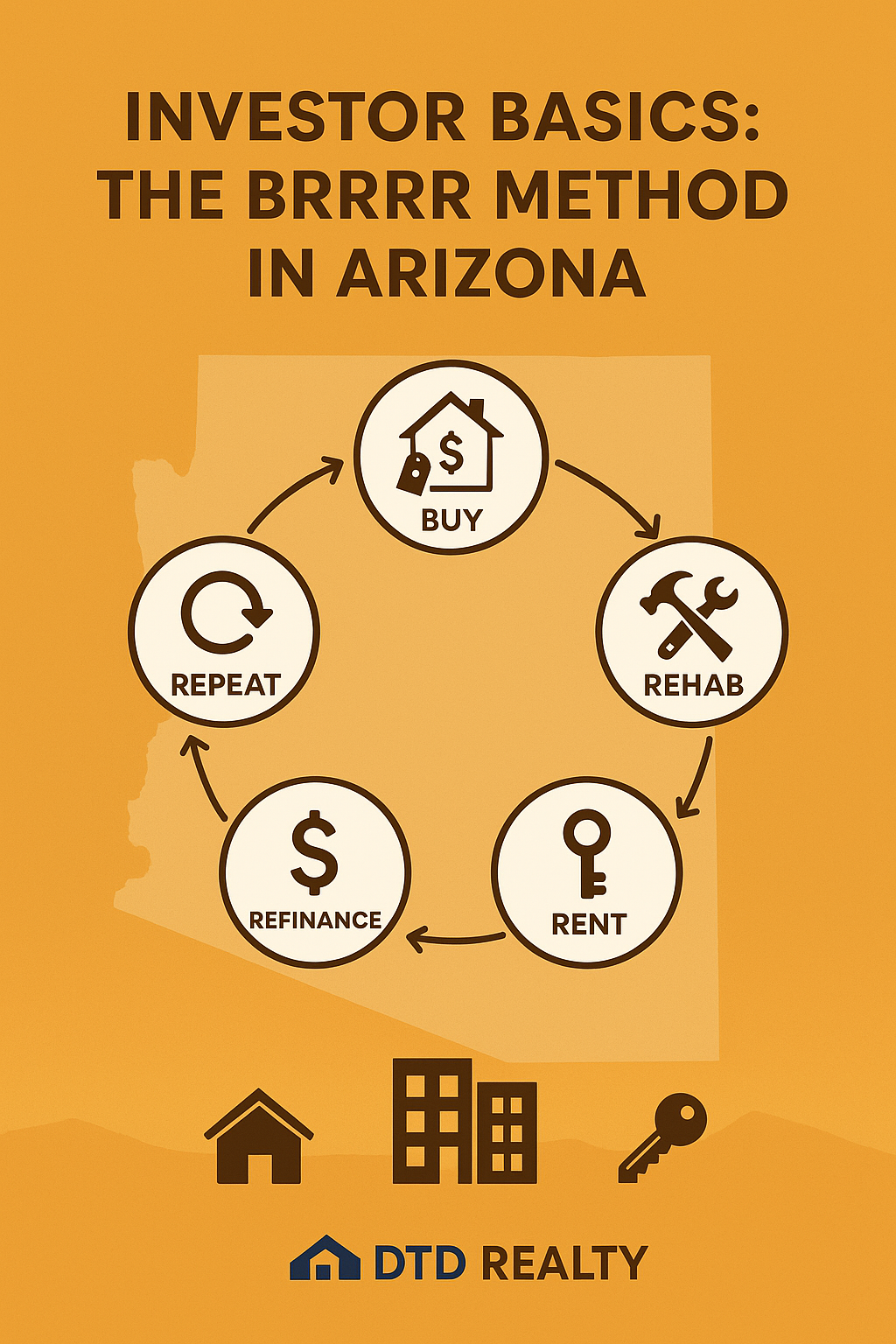

If you talk to any seasoned real estate investor in Arizona, eventually you’ll hear the acronym BRRRR. It stands for Buy, Rehab, Rent, Refinance, Repeat, and it’s one of the most popular strategies for accelerating portfolio growth—especially for investors who don’t have endless capital to deploy.BRRRR is powerful because it transforms a single down payment into multiple properties over time....

If you’re evaluating Arizona small business commercial loans in 2025, you’re likely trying to determine which financing structure supports your growth without draining cash flow. Arizona lenders are tightening underwriting, SBA programs are shifting, and commercial interest rates continue to stabilize—creating both opportunity and confusion. This guide breaks down the most realistic loan paths for...

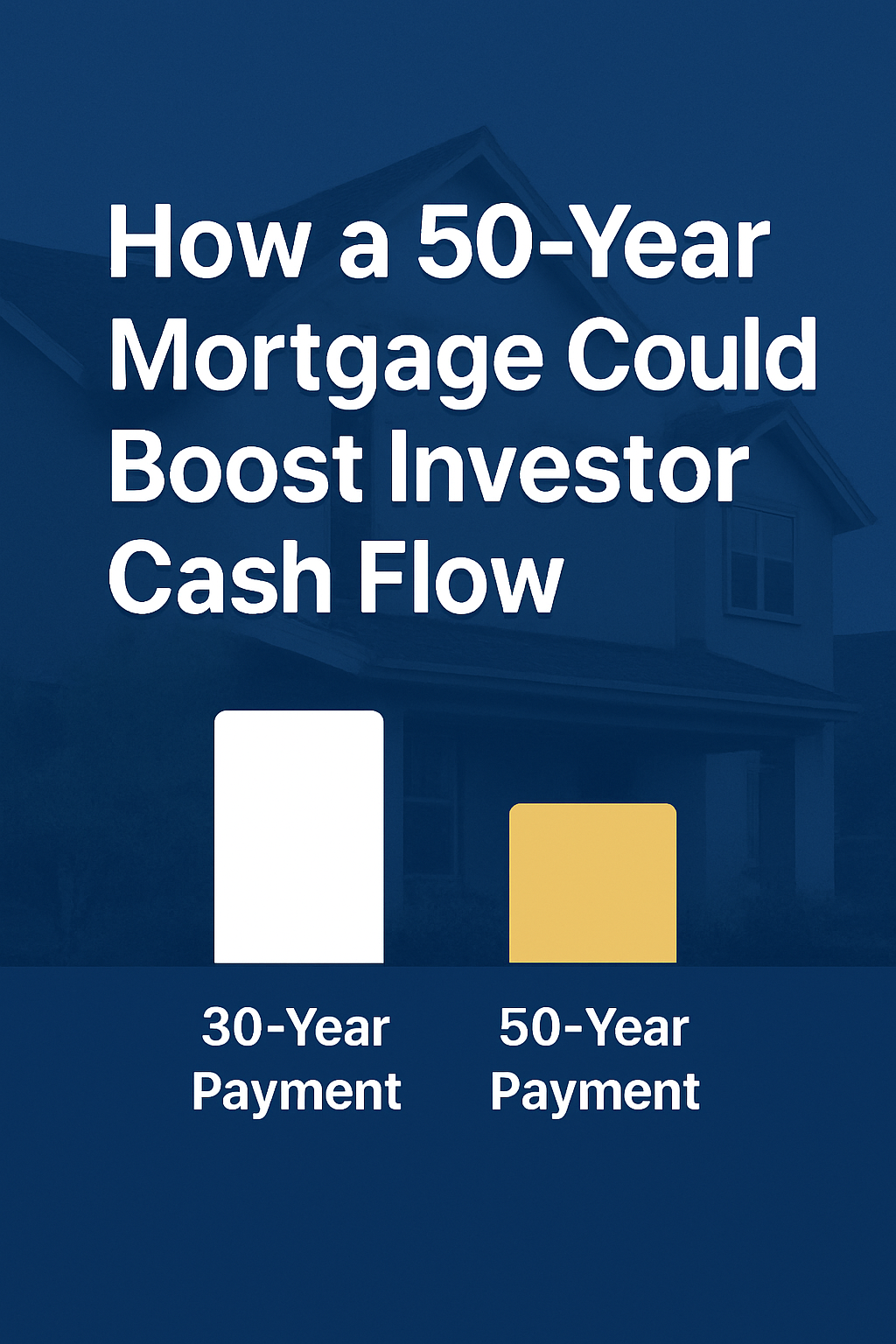

If you’re a real estate investor—or thinking about becoming one—you’ve probably seen the headlines about the administration’s proposal for a 50-year mortgage. Most commentary focuses on homeowners, but the real impact could be felt by investors, especially those using the BRRR (Buy-Rehab-Rent-Refinance-Repeat) method.While there are still big unknowns about whether investors will even be eligible...