Arizona investors love quick rules of thumb—and for good reason. When you’re screening dozens of potential rental properties, simple benchmarks help you separate “worth a deeper look” from “don’t waste time.”Two of the most popular rules are the 1% Rule and the 0.7% Rule.But here’s the catch: Arizona’s market is wildly different from the Midwest markets where these rules originally took...

Buying

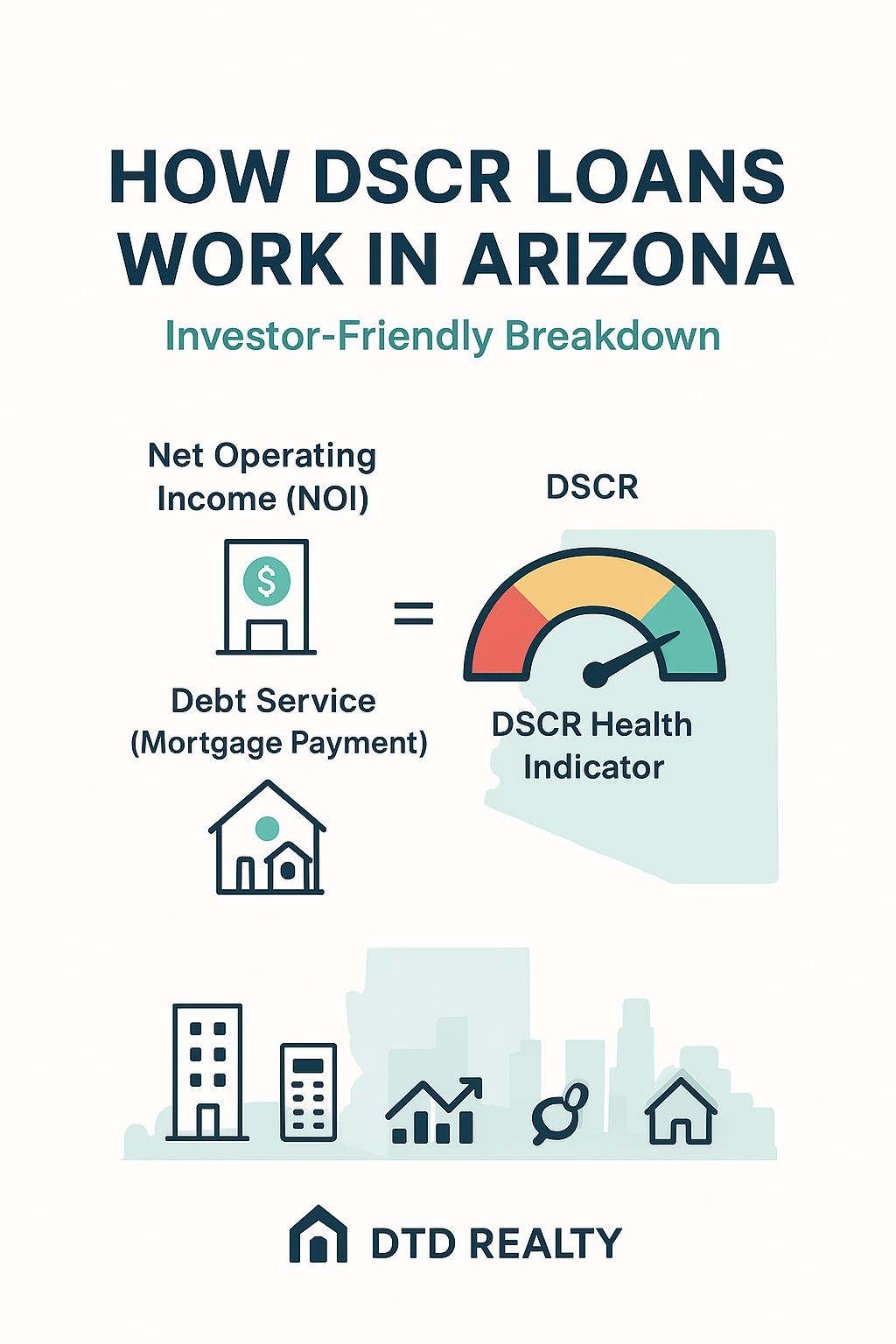

If you’re a newer investor looking to scale in Arizona, the term DSCR loan will come up almost immediately. These loans have exploded in popularity because they allow investors to qualify based on the property’s income, not their personal tax returns.For investors with self-employment income, multiple rental properties, or complex write-offs, DSCR financing can be a game-changer. They aren’t perfect,...

Seller concessions are becoming a powerful tool for Arizona home buyers—especially as affordability continues to tighten and mortgage rates remain elevated. But not all concessions are equal, and the type of seller you’re negotiating with matters more than ever. In today’s Arizona market, builders and resale sellers behave very differently, and successful buyers are tailoring their negotiation...

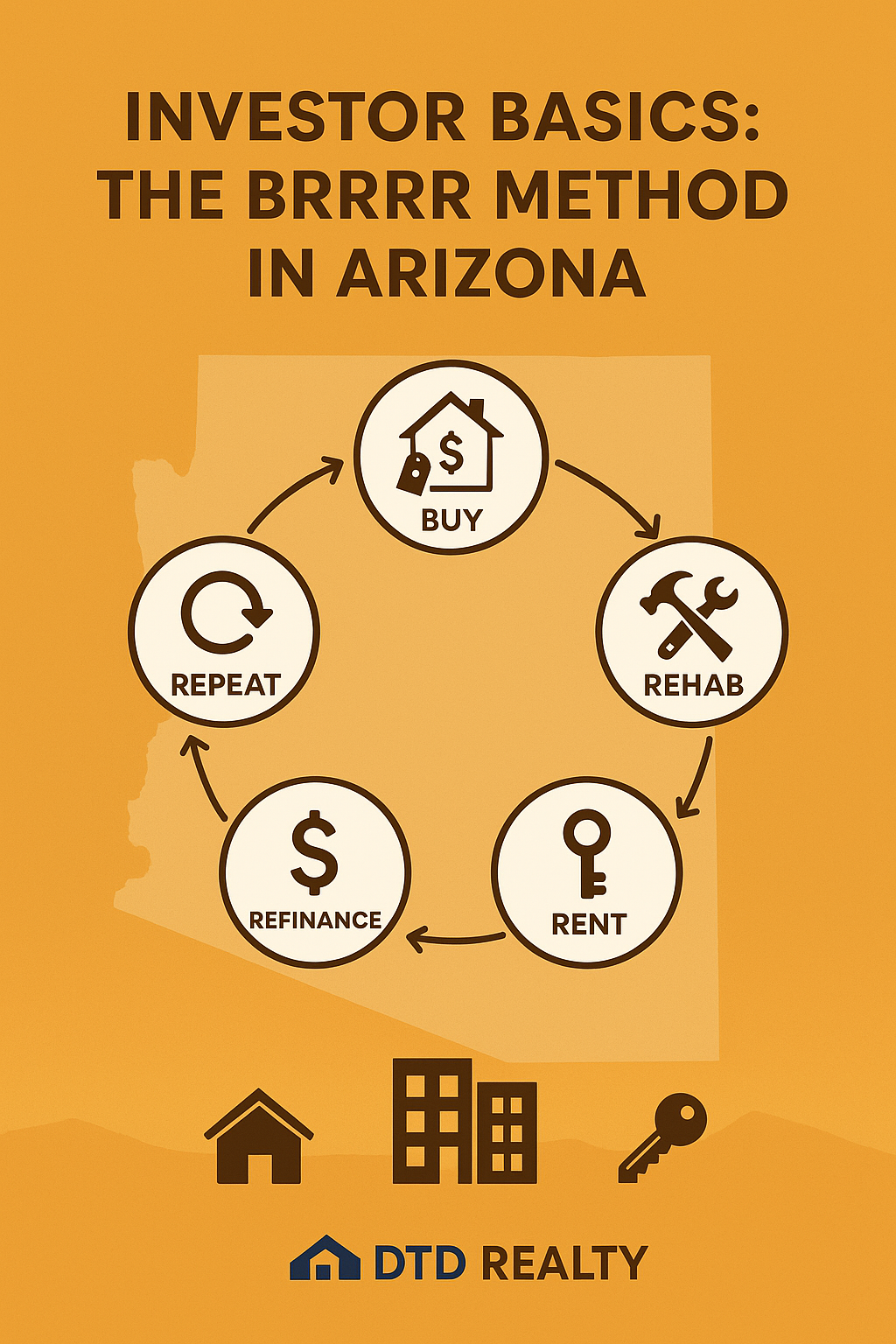

If you talk to any seasoned real estate investor in Arizona, eventually you’ll hear the acronym BRRRR. It stands for Buy, Rehab, Rent, Refinance, Repeat, and it’s one of the most popular strategies for accelerating portfolio growth—especially for investors who don’t have endless capital to deploy.BRRRR is powerful because it transforms a single down payment into multiple properties over time....

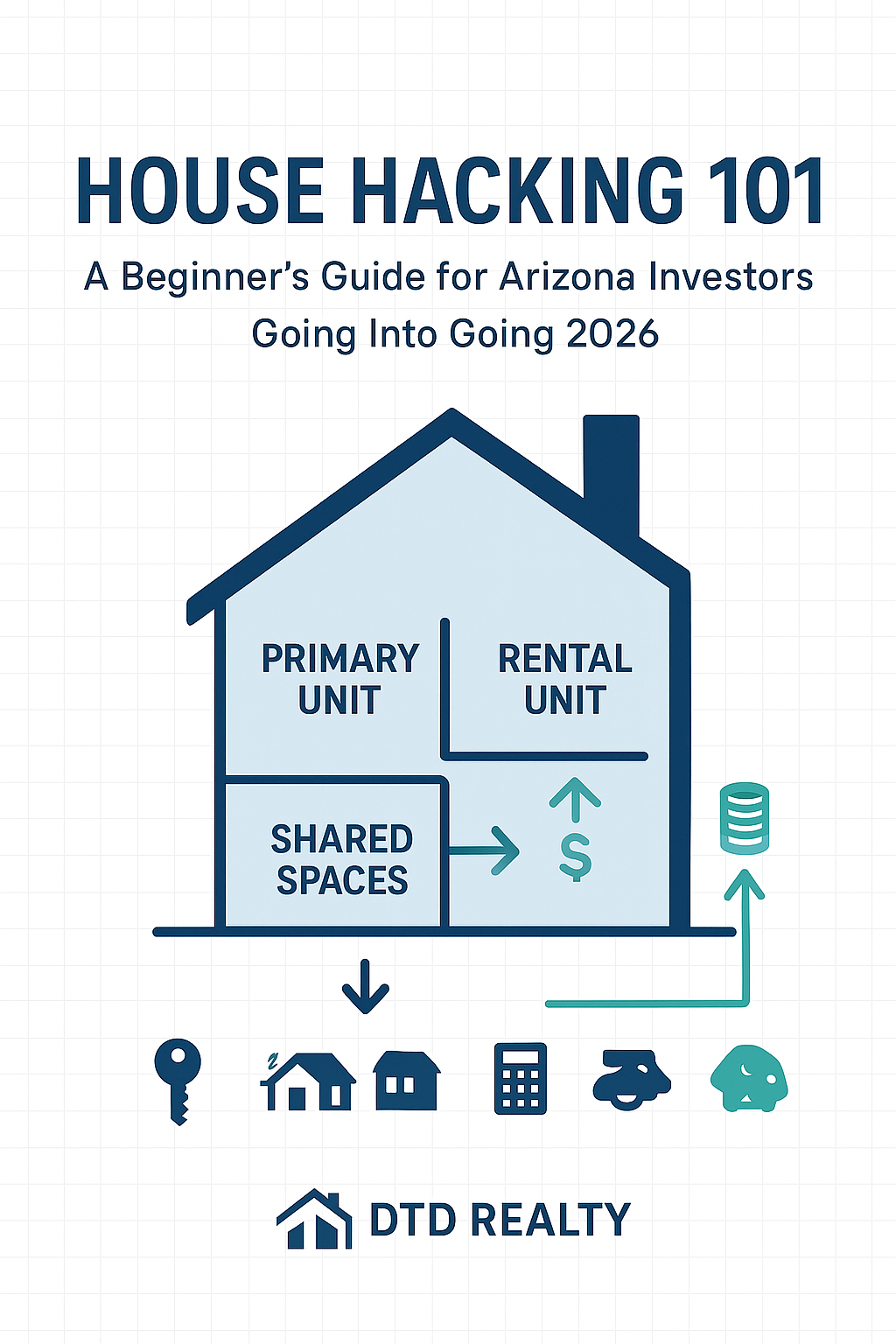

For new investors, house hacking is one of the simplest, safest, and smartest ways to build wealth through real estate. It’s the strategy that has launched thousands of investor careers nationwide—and it works especially well in Arizona, where rising rents, strong job growth, and a flexible lending environment create ideal conditions for beginner investors.This guide breaks down what house hacking is,...

Real estate investors love clarity — and Maricopa County’s Year-to-Date (YTD) 2025 data finally gives us a clean picture of what actually happened this year in the Phoenix metro single-family market. Using ARMLS data through October 2025, we can accurately analyze activity for detached single-family homes only (condos/townhomes/manufactured are excluded).Below is a breakdown of the most meaningful...

2025 marked a pivotal reset for Arizona real estate — especially for investors. Inventory climbed to multi-year highs, pricing flattened, operating costs surged, and underwriting discipline became the new competitive edge. It was also the first full year under major industry reforms: the One Big Beautiful Bill Act (OBBBA), new state-level housing initiatives, and the NAR settlement, which changed how...

Is Phoenix Still a Good Rental Market in 2026? A Brutally Honest Analysis for Out-of-State Investors

If you invest from out of state, Phoenix has probably been on — or near — the top of your radar for years. But after the rapid run-ups, the interest-rate roller coasters, and the wave of new multifamily construction, many investors are asking the same question: “Is Phoenix still a good rental market in 2026… or did I miss the window?” Let’s cut through the hype and take an honest, data-backed...

If you’re hoping to buy a home in 2026, Arizona townhomes may be the strongest—and most overlooked—path into the market.With interest rates projected to stabilize, new townhome construction booming across Phoenix’s most desirable neighborhoods, and lifestyle-driven buyers demanding walkability and design-forward communities, townhomes are becoming the sweet spot between affordability, amenities,...

House hacking has become one of Phoenix’s fastest-growing entry points for new real estate investors—and for good reason. Rising rents, strong job growth, and a new wave of younger buyers looking to build wealth are pushing duplexes, triplexes, ADUs, and rentable casitas back into the spotlight.But here’s the real challenge:Not every “affordable” area is a smart house hack.And not every...