Why Arizona Remains a Top Real Estate Investing Market

The foundation of any successful Arizona real estate investing guide starts with understanding why this market continues to attract long-term capital from both in-state and national investors. Arizona is not a speculation-driven market — it is a demographics- and fundamentals-driven market, which is exactly what disciplined investors look for.

1. Population & Job Growth Drive Long-Term Demand

Arizona continues to benefit from strong in-migration, fueled by:

- Business relocations

- Remote workers

- Retirees seeking affordability and tax efficiency

- Families drawn by job growth, universities, and quality of life

Greater Phoenix alone has ranked among the fastest-growing metros in the U.S. for multiple decades. This population growth directly supports:

- Long-term housing demand

- Rent growth

- Commercial occupancy

- Investor liquidity across cycles

For real estate investors, this translates into structural demand, not just seasonal momentum.

2. A Market That Supports Both Cash Flow and Appreciation

Unlike many coastal markets that force investors to choose between appreciation or cash flow, Arizona remains one of the few large metros where:

- Entry pricing is still achievable

- Rent-to-price ratios support cash flow

- Long-term price growth remains structurally supported

This makes Arizona uniquely suited for:

- Buy & hold strategies

- BRRRR value creation

- Small multifamily scaling

- Strategic commercial entry

It also means investors can build cash-flowing portfolios that still participate in long-term wealth expansion.

3. Diverse Submarkets Create Opportunity Across Risk Profiles

Arizona is not a single-market story. Investors can deploy capital across:

- Urban infill neighborhoods

- Suburban growth corridors

- University-driven rental zones

- Industrial & logistics districts

- Small-town cash-flow pockets

This flexibility is what allows experienced investors to diversify by submarket, tenant type, and price point without leaving the state — a major advantage for portfolio engineering.

4. Investor Liquidity & Exit Optionality

One of the most overlooked advantages in Arizona real estate is liquidity. Investors benefit from:

- Deep buyer pools

- Strong retail demand

- Institutional participation

- Active 1031 exchange traffic

This means:

- Easier refinances

- Strong resale velocity

- Flexible exit timing

- Better tax planning

Liquidity is what turns real estate from a fixed asset into a strategic financial tool.

5. Why This Matters for Long-Term Investors

Arizona allows investors to:

- Enter at realistic price points

- Scale methodically

- Compound returns through reinvestment

- Manage risk through diversification

- Exit on their terms

That combination is exactly why serious investors continue to concentrate capital here — and why this Arizona real estate investing guide is built around this market specifically.

For a recent review of how Arizona’s market moved this year, see our Arizona real estate market cycle analysis.

Choosing the Right Arizona Real Estate Investing Strategy

A successful Arizona real estate investing guide must go beyond market fundamentals and into strategy alignment. The reality is this: your returns are driven as much by strategy selection as they are by property selection. The same market can produce wildly different outcomes depending on how an investor deploys capital, manages operations, and structures risk.

There is no single “best” strategy in Arizona — but there is a best strategy for your goals, timeline, and risk profile.

Buy & Hold Investing in Arizona

Buy & hold remains the backbone of most long-term Arizona investor portfolios. This strategy focuses on:

- Acquiring stabilized or lightly improved properties

- Holding for cash flow

- Benefiting from long-term appreciation

- Using amortization and rent growth to build equity over time

Best suited for:

- Long-term investors

- High-income earners seeking tax shelter

- Investors building retirement income

- Those who prefer predictable performance over aggressive upside

Arizona’s rent-to-price ratios, population growth, and liquidity make it especially well-suited for disciplined long-term ownership. This strategy also pairs naturally with the metrics discussed in Cash Flow 101, Cap Rate for Beginners, and Understanding NOI.

The BRRRR Method in Arizona

The BRRRR strategy is a growth accelerator when executed correctly. Instead of deploying capital once, investors recycle capital repeatedly through:

- Buying under market

- Adding forced appreciation through rehabilitation

- Stabilizing with tenants

- Refinancing based on the new value

- Repeating the process

Best suited for:

- Active investors

- Investors with renovation experience or professional teams

- Growth-focused portfolios

- Investors prioritizing equity velocity over passive ownership

Arizona’s older housing stock in select submarkets creates consistent BRRRR opportunities — but execution discipline is critical. Cost overruns, timing risk, and tenant stabilization errors can quickly erode returns when leverage is high.

This strategy connects directly to your BRRRR Investor Basics post and DSCR lending for refinances.

Value-Add & Repositioning Strategies

Value-add investing sits between buy & hold and development. It focuses on:

- Operational inefficiencies

- Under-market rents

- Poor property management

- Deferred maintenance

- Outdated unit interiors

Instead of relying on market appreciation alone, investors increase value through execution and operations.

Best suited for:

- Experienced operators

- Small multifamily investors

- Light commercial investors

- Partnerships seeking higher upside

In Arizona, this is especially relevant for:

- 8–40 unit multifamily

- Older retail centers

- Small office and flex properties

This strategy also becomes a natural bridge into commercial real estate investing and mixed-use ownership.

Active vs. Passive Strategy Alignment

One of the most overlooked decisions investors make is choosing a strategy that does not align with their actual availability or temperament.

- Active investors tend to favor BRRRR, value-add, and self-managed portfolios.

- Passive-leaning investors tend to favor stabilized buy & hold, professional management, and lower leverage.

Arizona supports both — but trying to operate a high-touch strategy with low bandwidth often leads to operational drag and underperformance.

Strategy Must Match Your Life Stage

Your investing strategy should evolve as:

- Your capital base grows

- Your income stabilizes

- Your family and time constraints change

- Your retirement timeline shortens

For example:

- Early-stage investors often prioritize growth velocity

- Mid-career investors prioritize diversification and stabilization

- Late-stage investors prioritize income reliability and debt reduction

If you’re early in your investing career, consider house hacking in Arizona as a low-barrier entry strategy.

Why Strategy Selection Comes Before Deal Selection

Many investors search for “good deals” before defining their strategy. This is backward. The correct order is:

- Define strategy

- Define return targets

- Define risk tolerance

- Then filter deals

When investors reverse this order, they often accumulate mismatched assets that don’t perform as a cohesive portfolio.

This Arizona real estate investing guide is structured to prevent that exact mistake by helping investors choose how to invest before choosing what to buy.

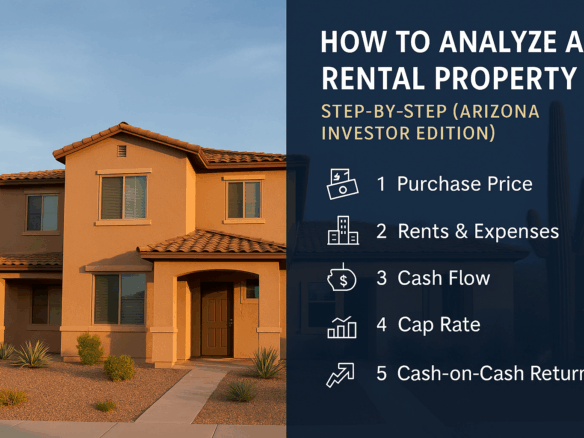

Understanding the Core Metrics Every Arizona Investor Must Master

Any serious Arizona real estate investing guide must ground investors in the metrics that actually control performance. Many investors make the mistake of chasing “good deals” based on emotion, surface-level pricing, or projected appreciation — instead of anchoring decisions in measurable fundamentals.

These five metrics form the backbone of sound Arizona investing:

- NOI (Net Operating Income)

- Cap Rate

- Cash Flow

- Cash-on-Cash Return

- The 1% Rule (and why Arizona often operates closer to 0.7%)

Mastering these numbers doesn’t just improve deal selection — it improves long-term portfolio stability.

NOI (Net Operating Income): The Engine Behind Value

NOI is the purest measure of a property’s income performance before financing. It is calculated as:

NOI = Gross Rental Income – Operating Expenses

Operating expenses include:

- Property taxes

- Insurance

- Repairs & maintenance

- Property management

- Utilities paid by ownership

- Reserves

They do not include:

- Mortgage payments

- Depreciation

- Income taxes

Why NOI matters in Arizona:

- NOI directly determines commercial and multifamily property value

- It controls refinance potential

- It drives cap rate calculations

- It reveals operational health

If you distort NOI with unrealistic expense assumptions, every other projection downstream becomes unreliable. This is why disciplined underwriting always starts with a clean NOI framework.

Cap Rate: Measuring Risk, Yield & Market Expectations

Cap rate expresses the relationship between a property’s income and its price:

Cap Rate = NOI ÷ Purchase Price

Cap rate is not just a return metric — it reflects:

- Market risk perception

- Asset class stability

- Submarket liquidity

- Interest rate environment

In Arizona:

- Urban infill and Class A assets tend to trade at lower cap rates

- Cash-flow-oriented submarkets tend to trade at higher cap rates

- Commercial cap rates are typically higher than residential

Cap rates help investors compare:

- One property to another

- Arizona assets to out-of-state opportunities

- Passive yield expectations over time

Cash Flow: The Oxygen of Your Portfolio

Cash flow is what remains after all expenses and debt service are paid:

Cash Flow = NOI – Mortgage Payments

Cash flow allows investors to:

- Cover vacancies

- Absorb repairs

- Fund future acquisitions

- Stabilize personal income

- Ride out market volatility

In Arizona, smart investors underwrite conservative rent growth, realistic insurance costs, and rising tax assessments — not best-case projections. Sustainable cash flow keeps portfolios alive long enough for appreciation, debt paydown, and tax benefits to do their work.

Cash-on-Cash Return: Measuring Efficiency of Invested Capital

Cash-on-cash return answers a different question than cash flow:

“How hard is my actual invested cash working for me?”

Cash-on-Cash = Annual Pre-Tax Cash Flow ÷ Total Cash Invested

This metric is especially important for:

- Leveraged investments

- BRRRR strategies

- Portfolio scaling

- Private lending alternatives

Two properties may have the same cash flow — but very different cash-on-cash returns depending on:

- Down payment size

- Rehab capital

- Financing structure

This is why professional investors prioritize capital efficiency, not just monthly income.

The 1% Rule vs. Arizona Market Reality

The traditional 1% Rule suggests that monthly rent should equal 1% of the purchase price. While this can still appear in select Arizona submarkets, most core Phoenix-metro properties now operate closer to:

- 0.6%–0.8% in stabilized neighborhoods

- Higher in select cash-flow-focused corridors

The rule itself is not dead — but it must be interpreted in context, alongside:

- Financing terms

- Insurance costs

- Management expenses

- Tax assessments

- Long-term appreciation potential

Arizona investors succeed by balancing rule-of-thumb screening with full underwriting discipline.

Why These Metrics Must Work Together — Not in Isolation

NOI determines value

Cap rate determines market yield

Cash flow determines portfolio survival

Cash-on-cash determines capital efficiency

The 1% rule determines early deal screening

When investors over-focus on only one of these metrics, they frequently:

- Overpay

- Underestimate expenses

- Misjudge risk

- Misallocate capital

- Stall portfolio growth

This is why disciplined Arizona investors operate from a full metric framework, not a single shortcut.

Metrics Protect You From Emotional Investing

Markets rise. Markets fall. Headlines change. Interest rates cycle.

Metrics don’t react emotionally — and neither should investors. When every deal is filtered through:

- NOI accuracy

- Conservative cash flow

- Capital efficiency

- Exit liquidity

Your portfolio becomes resilient by design, not by hope.

This is the difference between speculation and strategy — and it’s the foundation every serious investor should build upon.

Financing Options for Arizona Real Estate Investors

Every successful Arizona real estate investing guide must address one critical truth: returns are created by structure as much as by selection. Two investors can buy the exact same property and generate radically different outcomes based solely on how the deal is financed.

In Arizona, investors typically operate across three core lending categories:

- Conventional residential loans

- DSCR (Debt Service Coverage Ratio) loans

- Portfolio and commercial loans

Each serves a specific role depending on experience level, portfolio size, and strategic intent.

Conventional Financing: The Entry Point for Many Investors

Conventional loans remain the most common starting point for new Arizona investors. These loans usually feature:

- Lower interest rates

- Lower down payment requirements

- Fixed-term stability

- Strict underwriting standards

Best suited for:

- First-time investors

- House hackers

- Investors with strong personal income

- Early-stage buy & hold portfolios

The downside is scalability. Conventional lending is typically capped at 10 financed properties per borrower, and underwriting is heavily tied to:

- Personal income

- Debt-to-income ratios

- W-2 earnings

For investors seeking aggressive portfolio growth, conventional financing eventually becomes a bottleneck.

DSCR Loans: Scaling Without Personal Income Limitations

DSCR loans evaluate the property’s income, not the borrower’s personal tax returns. Instead of underwriting based on W-2 income, lenders analyze whether the rent covers the debt service.

This makes DSCR lending especially powerful for:

- Self-employed investors

- Business owners

- BRRRR portfolios

- Investors scaling beyond conventional caps

Key characteristics of DSCR loans include:

- Qualification based on property performance

- Higher interest rates than conventional

- Larger down payments

- Greater flexibility in portfolio size

When used strategically, DSCR lending allows investors to separate portfolio growth from personal income constraints, making it one of the most powerful tools for scaling in Arizona.

Portfolio & Commercial Lending

Once investors move beyond small residential portfolios, they often shift into:

- Portfolio loans

- Small commercial loans

- Local bank and credit union programs

These loans are typically underwritten based on:

- Global cash flow

- Sponsor experience

- Asset performance

- Market conditions

- Business financials

This is the financing tier where investors begin accessing:

- Small multifamily

- Mixed-use

- Industrial & flex

- Retail & office

The underwriting becomes relationship-driven rather than formula-driven, and capital access expands as credibility increases.

To learn more about commercial loan options, review this guide on commercial loans before selecting a lender.

Short-Term Capital: Bridge & Renovation Financing

For active investors executing:

- BRRRR strategies

- Heavy value-add projects

- Distressed acquisitions

Short-term capital may be sourced via:

- Hard money

- Bridge loans

- Private capital

These loans offer:

- Speed of execution

- Flexible underwriting

- Asset-based approvals

But they also carry:

- Higher interest rates

- Short repayment windows

- Execution risk

Short-term capital should be viewed as a tactical tool, not a long-term portfolio foundation.

How Financing Strategy Impacts Portfolio Stability

Financing decisions affect:

- Monthly cash flow

- Refinance flexibility

- Exit timing

- Crisis survivability

- Long-term return on equity

Over-leveraging during expansion phases often creates:

- Thin cash flow margins

- Refinance vulnerability

- Forced selling during downturns

Conversely, disciplined leverage allows investors to:

- Absorb insurance increases

- Absorb tax reassessments

- Ride through rental fluctuations

- Maintain strategic optionality

The Right Financing Mix Evolves Over Time

Early-stage investors often rely on:

- Conventional loans

- Personal income qualification

Mid-stage investors shift toward:

- DSCR loans

- Portfolio lending

- Global cash flow structures

Advanced investors operate through:

- Commercial balance sheets

- Banking relationships

- Tax-optimized entity structures

The optimal capital stack evolves as your portfolio matures — and financing strategy should never be static.

Scaling Beyond Your First Few Properties

The transition from owning a few rentals to operating a true portfolio is where most investors either break through — or stall out. Any complete Arizona real estate investing guide must address this phase directly, because the skills required to buy your third property are very different from the skills required to manage ten, twenty, or more.

Scaling is not just about buying more property. It’s about building systems, structure, and discipline that allow growth without chaos.

From Owner-Operator to Portfolio Manager

Early-stage investors often wear every hat:

- Leasing

- Maintenance coordination

- Bookkeeping

- Financing

- Asset management

As portfolios grow, that model becomes unsustainable. Successful Arizona investors eventually shift into:

- Professional property management

- Third-party accounting

- Standardized reporting

- Vendor relationships

- Defined operating procedures

This shift doesn’t reduce control — it increases visibility and scalability.

Capital Stacking: How Growth Is Actually Funded

Scaling portfolios requires capital that comes from multiple sources, not just savings. Advanced investors commonly layer:

- Equity from refinances

- 1031 exchange proceeds

- Private capital partners

- Business income

- Institutional portfolio lending

The key shift is this:

Growth becomes capital-structure driven, not paycheck-driven.

Investors who fail to understand capital stacking often slow down — not because deals disappear, but because capital access becomes the limiting factor.

Leverage Discipline Is a Scaling Skill — Not Just a Financing Choice

Leverage accelerates growth, but it also amplifies risk. The most common portfolio-level mistakes come from:

- Aggressive underwriting

- Thin cash flow margins

- Overreliance on short-term debt

- Refinancing into unfavorable rate environments

Professional investors scale with:

- Conservative debt service coverage

- Strong liquidity buffers

- Fixed-rate debt where possible

- Staggered maturity timelines

This discipline allows portfolios to survive:

- Interest rate cycles

- Credit tightening

- Insurance spikes

- Economic slowdowns

Scaling without leverage discipline turns growth into fragility.

Partnerships as a Force Multiplier — or a Liability

Partnerships can dramatically accelerate scale when structured properly. They allow:

- Larger deal sizes

- Risk sharing

- Specialized roles

- Expanded capital pools

But they can also become portfolio liabilities when:

- Roles are undefined

- Expectations are misaligned

- Capital timelines conflict

- Exit rights are unclear

Successful Arizona investors use:

- Clear operating agreements

- Defined decision authority

- Transparent reporting

- Pre-negotiated exit mechanisms

Partnerships should reduce operational friction — not create it.

Geographic & Asset-Class Scaling

Scaling is not only about unit count. It also includes:

- Expanding into multiple Arizona submarkets

- Adding small multifamily

- Introducing light commercial

- Integrating mixed-use or industrial assets

This kind of scaling improves:

- Geographic risk diversification

- Tenant-type diversification

- Lease-duration balance

- Inflation resistance

This section intentionally sets up the future “Diversified Portfolio in Arizona” cornerstone, which will go deeper into portfolio construction.

Operational Complexity Rises Faster Than Unit Count

One of the biggest surprises investors face when scaling is that:

Complexity grows faster than revenue.

Scaling exposes:

- Vendor dependency risks

- Legal exposure

- Regulatory compliance

- Insurance gaps

- Portfolio-wide cash flow imbalances

The fix is not to slow growth — it’s to professionalize operations before the portfolio forces you to.

Why Scaling Is a System — Not a Sprint

Investors who scale sustainably in Arizona do so by:

- Standardizing acquisition criteria

- Tracking performance across the entire portfolio

- Applying consistent leverage rules

- Managing for 20–30% downside scenarios

- Maintaining multi-year capital plans

Scaling is not a volume contest. It is a long-term system design problem — and the investors who treat it that way are the ones who still control their portfolios when the next market cycle arrives.

Risk Management, Insurance & Market Cycles in Arizona

Every real estate investor benefits from appreciation during strong markets. But the investors who build lasting wealth are the ones who survive downturns without being forced to sell. In Arizona, proper risk management is no longer optional — it is a core investment skill.

This section of the Arizona real estate investing guide focuses on how successful investors protect their portfolios from the risks that destroy leverage-heavy, under-protected portfolios when conditions shift.

The Three Primary Risks Arizona Investors Face

Arizona investors are currently navigating three growing risks at the same time:

- Insurance volatility

- Property tax assessments rising faster than rents

- Interest rate–driven cash flow compression

Together, these forces pressure margins even on properties that looked conservative just a few years ago. Investors who only underwrite to today’s numbers — without stress testing tomorrow’s — are the most exposed.

Insurance Is Now a Portfolio-Level Strategy, Not a Line Item

Insurance has quietly become one of the fastest-growing operating expenses in Arizona. Carriers are reacting to:

- Increased construction costs

- Climate-driven risk models

- Higher claim severity

- Litigation inflation

Professional investors now:

- Re-shop insurance annually

- Use higher deductibles strategically

- Separate liability umbrellas from property coverage

- Require stricter tenant insurance compliance

- Track insurance as a portfolio risk metric, not just a property expense

Failure to manage insurance proactively is one of the fastest ways to erode long-term profitability.

Property Taxes: The Hidden Cash Flow Killer

Many Arizona investors underestimate how quickly property taxes reset after purchase or valuation increases. This creates a common scenario:

“The deal penciled — until the reassessment arrived.”

Smart investors:

- Underwrite post-purchase tax resets

- Model assessment increases every 1–2 years

- Budget appeal costs

- Monitor assessor projections annually

Ignoring tax risk is not a passive investing strategy — it’s a deferred planning failure.

Market Cycles Are Inevitable — Distress Is Optional

Arizona is a high-growth market, and with growth comes volatility. The past two decades alone have clearly demonstrated:

- Boom-driven price acceleration

- Sharp credit contractions

- Rapid rate cycles

- Investor sentiment whiplash

Professional investors do not attempt to predict cycles. Instead, they build portfolios that:

- Maintain conservative debt service coverage

- Hold strong operating reserves

- Avoid short-term balloon risk

- Maintain fixed-rate debt where possible

- Stress test rent declines, not just growth

Survival through the cycle is what ultimately produces outsized long-term returns.

Liquidity Is a Risk-Management Tool — Not “Idle Cash”

Many investors treat liquidity as inefficient capital. In reality, liquidity is:

- Insurance against forced sales

- A cushion against market shocks

- Dry powder for distressed acquisition windows

Arizona investors who scaled aggressively without adequate liquidity in previous downturns often became unintentional sellers — not strategic buyers.

Operational Risk Multiplies as Portfolios Grow

As portfolios scale, risks expand beyond the market:

- Vendor dependency

- Maintenance backlogs

- Manager performance gaps

- Tenant concentration

- Regulatory compliance

Investors who survive growth sustainably treat operations as a risk category on par with financing and market conditions.

The Goal of Risk Management Is Not Safety — It’s Control

Risk management is not about eliminating risk entirely. That’s impossible in real estate. The goal is maintaining control under pressure:

- Control over cash flow

- Control over refinancing timelines

- Control over exit timing

- Control over asset allocation

Investors who retain control through rising rates, insurance spikes, and tax resets are the ones who build true multi-cycle wealth.

How Risk Ties Directly Into Your Long-Term Portfolio Strategy

Your risk profile should evolve with:

- Your age

- Your income stability

- Your portfolio size

- Your reliance on real estate cash flow

- Your retirement timeline

This is why one-size-fits-all investing advice fails. What’s aggressive at 32 may be reckless at 58. What’s conservative at 40 may be overly defensive at 65.

This is also where professional advisory guidance becomes far more valuable than deal-by-deal analysis alone.

Tax Strategy & Exit Planning for Arizona Investors

Real estate is not just an income vehicle — it is one of the most powerful tax-advantaged wealth-building tools available to Arizona investors when structured correctly. But those tax advantages only reach their full potential when paired with intentional exit planning.

This final section of the Arizona real estate investing guide connects everything that came before it — acquisitions, financing, cash flow, risk management, and diversification — into a long-term wealth strategy built for:

- Stability

- Tax efficiency

- Retirement income

- Asset protection

- Legacy planning

Investors who fail to plan their exits don’t just pay more in taxes — they often lose optionality when it matters most.

The Three Phases of Real Estate Wealth

Every investor portfolio — whether intentional or not — moves through three phases:

- Accumulation Phase

Focus: Acquisitions, leverage, scaling, reinvestment - Optimization Phase

Focus: Refinancing, improving NOI, repositioning, tax efficiency - Distribution Phase

Focus: Income stability, risk reduction, taxable event planning, wealth transfer

Problems arise when investors stay stuck in the accumulation mindset long after their risk tolerance, age, and financial needs have changed.

Depreciation: The Most Underutilized Wealth Tool in Arizona Investing

Depreciation allows investors to:

- Offset rental income

- Reduce taxable cash flow

- Shelter income from other sources

- Improve after-tax returns significantly

Advanced strategies like cost segregation can further accelerate deductions, but even standard depreciation delivers massive long-term tax advantages when paired with:

- Long-term holds

- Reinvestments

- Strategic dispositions

Depreciation is not a “nice bonus” — it is a core pillar of real estate investing.

1031 Exchanges as a Portfolio Strategy — Not Just a Tax Deferral Tool

A properly executed 1031 exchange allows Arizona investors to:

- Defer capital gains taxes

- Defer depreciation recapture

- Preserve acquisition capital

- Trade up in asset class

- Improve income and diversification

- Strategically reduce management burden over time

1031 exchanges are frequently used to:

- Trade several homes into one larger commercial asset

- Reposition from active to passive ownership

- Transition from high-management assets into stabilized income

However, 1031s require strict compliance and must always be coordinated with a qualified tax professional.

Exit Planning Is Not About Selling — It’s About Timing Control

Exit planning answers questions like:

- When will I stop acquiring aggressively?

- When will I start de-leveraging?

- When does income stability matter more than growth?

- How will assets transfer to heirs or trusts?

- How will taxes be managed at each stage?

Without planning, exits become reactive instead of strategic.

Fixed-Income Real Estate: The Retirement Transition Phase

Many Arizona investors eventually shift toward:

- Fully amortizing debt

- Lower leverage

- Stabilized assets

- Predictable income streams

- Reduced tenant and operational complexity

This transition creates:

- Lower risk

- Higher income certainty

- Better lender terms

- Estate-friendly structures

Real estate becomes less about “wins” and more about durability.

Entity Structuring & Asset Protection Matter More as Portfolios Grow

As wealth accumulates, so does exposure. Advanced investors:

- Separate operating entities from holding entities

- Use layered LLC structures where appropriate

- Incorporate trusts into succession planning

- Evaluate state-specific asset protection laws

- Coordinate insurance with entity structures

Asset protection is not about fear — it’s about sustainability and longevity.

The True Power of Arizona Real Estate Is Multi-Generational

When structured correctly, Arizona real estate portfolios can:

- Provide lifetime income

- Transfer wealth to heirs efficiently

- Fund business ventures

- Support philanthropy

- Create long-term financial independence

What begins as a single rental can evolve into a family balance sheet.

Why Professional Guidance Becomes Critical at This Stage

As portfolios mature, the complexity increases. At this phase, successful investors rely on:

- Real estate attorneys

- CPAs with real estate specialization

- Tax strategists

- Wealth planners

- Local market specialists

This is not about outsourcing responsibility — it is about upgrading decision quality.

Final Thought: The End Game Is Not Maximum Units — It’s Maximum Control

Control over:

- Your income

- Your taxes

- Your risk

- Your retirement timeline

- Your legacy

Arizona real estate gives investors unique flexibility across all five — but only if it is handled with intention.

How to Build a Diversified Real Estate Portfolio in Arizona

Diversification in real estate is not about owning “a little of everything.” It is about intentionally balancing income, growth, risk, and liquidity across different property types, submarkets, and investment timelines — all within the unique dynamics of the Arizona market.

A properly diversified Arizona portfolio is designed to do three things at the same time:

- Produce stable cash flow

- Capture long-term appreciation

- Protect capital during market disruptions

When diversification is done poorly, investors end up with scattered properties and inconsistent performance. When done correctly, it becomes the engine that smooths volatility while accelerating long-term wealth.

Diversification Starts With Your Personal Strategy — Not the Deal

Before selecting asset types or submarkets, every investor must first clarify:

- Are you still in growth mode or nearing income replacement?

- Do you rely on real estate cash flow to pay living expenses?

- Do you have a stable W-2 income or fluctuating business income?

- When do you want the option to retire?

- How much leverage stress can you truly tolerate?

Two investors can buy identical properties and still be making very different strategic decisions based on these answers.

Diversification must match your stage of life — not just market conditions.

Asset-Type Diversification in Arizona

Each asset class in Arizona plays a different role inside a portfolio:

- Single-Family Rentals (SFH)

Strong liquidity, easier financing, broad tenant base, appreciation-driven. - Small Multifamily (2–20 units)

Higher income efficiency, better expense ratios, stronger long-term cash flow. - Commercial (Retail, Office, Industrial)

Longer leases, higher income potential, greater complexity, business-cycle exposure. - Short-Term Rentals (STRs)

Revenue acceleration potential, seasonality risk, regulatory sensitivity. - Land & Development Plays

High appreciation potential, low cash flow, longer timelines.

True diversification blends income-focused assets with growth-oriented assets, so the portfolio is not dependent on a single return driver.

Submarket Diversification Inside Arizona Matters Just as Much as Asset Type

Arizona is not one market — it is a collection of very different micro-economies. A sophisticated portfolio may intentionally spread exposure across:

- Urban Core (Phoenix, Tempe, Scottsdale)

Employment density, renter demand, long-term appreciation pressure. - Growth Corridors (East Valley, West Valley)

New construction, family renters, school-driven demand, scalable inventory. - Workforce Submarkets

Recession-resistant tenants, consistent occupancy, slower appreciation. - Tourism & Lifestyle Markets

Short-term rental exposure, second-home demand, seasonal revenue patterns.

Geographic diversification protects investors from:

- Local employer shutdowns

- Zoning shifts

- Regulatory changes

- Insurance and tax volatility that can hit certain areas harder than others

Blending Cash Flow and Appreciation — The Core Balancing Act

Many investors fall into one of two traps:

- Chasing appreciation with thin cash flow

- Chasing cash flow in stagnant markets

In Arizona, long-term success comes from balancing both:

- Cash-flowing assets create income stability and reinvestment power

- Appreciation-driven assets create equity growth and refinancing leverage

A diversified portfolio allows:

- Appreciation during expansion cycles

- Income durability during slowdowns

- Refinancing opportunities when rates fall

- Defensive income when acquisition windows tighten

Sample Portfolio Allocations by Investor Profile

While every investor is different, here are simplified examples:

30s–Early 40s (Growth-Focused Builders)

- 50–70% SFH & small multifamily

- 20–30% appreciation-driven growth areas

- 0–10% speculative or development exposure

Mid-40s–50s (Hybrid Growth + Income)

- 40–50% income-stabilized assets

- 30–40% appreciation-driven assets

- 10–20% diversification into commercial or STRs

Late 50s+ (Income & Preservation Focused)

- 60–80% stabilized income assets

- 10–20% appreciation or value-add

- Minimal speculative exposure

These shifts are not about age alone — they reflect changing risk tolerance, income needs, and lifestyle priorities.

Diversification Is Also About Capital Access & Liquidity

Portfolio structure impacts:

- Lending flexibility

- Refinance options

- 1031 exchange pathways

- Emergency liquidity

- Exit optionality

Holding only one type of asset in one submarket creates:

- Higher exposure to local downturns

- Fewer refinancing options

- Limited buyer pools during exits

Diversification increases strategic optionality, which is one of the most undervalued advantages in real estate investing.

The True Goal of Diversification: Stability With Upside

The most resilient Arizona portfolios are not the flashiest. They are engineered to:

- Produce consistent income

- Capture long-term growth

- Maintain liquidity under pressure

- Withstand insurance, tax, and rate volatility

- Provide multiple exit paths at every phase of ownership

Diversification is not about owning more properties — it is about owning the right mix of properties for your long-term vision.

Common Arizona Investor Mistakes That Destroy Returns

Arizona offers exceptional long-term real estate opportunity — but it also punishes poorly structured investing strategies faster than many other markets. The investors who struggle here rarely fail because they picked the “wrong” property. They fail because they made systemic strategic mistakes that quietly erode cash flow, amplify risk, and trap capital at the worst possible times.

These are the most common — and most damaging — mistakes we see Arizona investors make.

1. Overpaying in “Hot” Zip Codes With No Margin for Error

Chasing the most popular neighborhoods often results in:

- Thin or negative cash flow

- Overreliance on appreciation

- No room for taxes, insurance, or rate shocks

In Arizona, price momentum can reverse faster than most investors expect. Buying without a margin of safety turns normal market fluctuation into portfolio damage.

2. Ignoring Post-Purchase Property Tax Resets

Many first-time and out-of-state investors underwrite using the seller’s tax bill instead of modeling future valuations. After purchase:

- Assessed values reset

- Monthly escrow increases

- Cash flow shrinks unexpectedly

This mistake alone has turned countless “good deals” into long-term underperformers.

3. Underestimating the Impact of Rising Insurance Costs

Insurance is no longer a static operating expense. Carriers are actively repricing risk across Arizona based on:

- Climate modeling

- Claim frequency

- Construction cost inflation

- Litigation trends

Investors who fail to stress test insurance escalation often experience slow but unstoppable return compression.

4. Using the Wrong Loan Product for the Strategy

A common mistake is mismatching financing to long-term goals:

- Short-term ARMs on long-term holds

- High-leverage DSCR loans without reserves

- Refinancing too early to pull capital for new deals

- Balloon structures on stabilization-dependent properties

Debt structure should serve the portfolio — not control it.

5. Building Portfolios With No Liquidity Buffer

Scaling without reserves creates a fragile portfolio. Without proper liquidity:

- Maintenance backlogs grow

- Emergency capital comes from high-interest credit

- Forced sales become likely during downturns

Liquidity is not inefficiency — it is defensive capital.

6. Confusing Appreciation With Performance

Price growth does not equal return. True performance is measured by:

- Net operating income

- Debt service coverage

- After-tax cash flow

- Equity velocity

- Risk-adjusted return

Portfolios built solely on price movement collapse quickly when markets normalize.

7. Overconcentration in One Submarket

Holding six properties in one submarket is not diversification — it is geographic leverage. Local risks can include:

- School district changes

- Zoning shifts

- Employer relocations

- Infrastructure delays

- Crime pattern changes

Geographic concentration magnifies downside risk without providing additional upside.

8. Scaling Self-Management Beyond Its Natural Limit

Self-management works beautifully at small scale. It often fails at larger scale due to:

- Vendor dependency

- Delayed decision-making

- Burnout

- Tenant quality drift

- Compliance exposure

Operational cracks widen quickly as portfolios grow.

9. Ignoring Exit Strategy At the Time of Purchase

Many investors buy with no clarity on:

- Sell vs. refinance timeline

- 1031 exchange planning

- De-leveraging phase

- Retirement income target

- Estate planning integration

Without exit planning, portfolios grow — but wealth does not consolidate.

10. Letting Emotion Drive Acquisition Decisions

FOMO, social proof, and influencer-driven narratives cause investors to:

- Overpay

- Over-leverage

- Underwrite optimistically

- Skip stress testing

Professional investing is not emotional — it is probabilistic.

The Common Thread Across All These Mistakes

Every mistake above has one thing in common:

Investors focus on the deal — instead of the system.

Great portfolios are not built from isolated transactions. They are built from repeatable decision frameworks, disciplined underwriting, and long-term strategic alignment.

Why Avoiding These Mistakes Is a Competitive Advantage in Arizona

The Arizona market will continue to reward:

- Capital discipline

- Conservative underwriting

- Portfolio-level thinking

- Tax-aware planning

- Risk-controlled scaling

Avoiding invisible errors is often more powerful than chasing high-profile upside.

How DTD Realty Helps Arizona Investors Execute Smarter

Education builds confidence. Strategy builds clarity. But execution is where real wealth is created or destroyed. The Arizona market rewards disciplined operators — and punishes investors who move without proper guidance, systems, and local intelligence.

DTD Realty exists to bridge the gap between knowing what to do and executing it correctly in real-world conditions.

We work with investors at every stage:

- First-time buyers building their foundation

- Scaling investors assembling multi-property portfolios

- Business owners aligning real estate with cash flow and tax planning

- Long-term holders positioning for retirement and legacy

Our role is not to push deals — it is to protect capital, improve decision quality, and align each acquisition with your long-term plan.

Strategy First — Not “Deal First”

Most investors are shown properties before they are shown a strategy. That is backwards.

At DTD Realty, we reverse that process:

- We clarify your income vs. growth goals

- We assess your risk tolerance and liquidity

- We evaluate your time horizon and exit planning

- We align financing with portfolio intent

- We define your target submarkets and asset classes

Only then do we move into acquisition mode — with criteria that protects you from emotional buying and poor-fit deals.

Local Market Intelligence That Actually Impacts Returns

Arizona is a collection of highly specialized micro-markets. The difference between a strong deal and a weak one is often found in:

- Street-level tenant demand

- Rent elasticity within school districts

- Construction pipeline impacts

- Zoning behavior

- Insurance exposure by region

- Employer migration patterns

DTD Realty’s role is to turn local insight into underwriting advantage — not just supply listing alerts.

Deal Underwriting Through a Portfolio Lens

We analyze every deal in context of:

- Existing portfolio concentration

- Debt exposure

- Cash flow stability

- Tax positioning

- Refinance optionality

- Exit flexibility

This prevents:

- Overconcentration

- Cash flow compression

- Loan product mismatch

- Liquidity drain

- Long-term planning conflicts

One good deal should strengthen the entire portfolio — not create new hidden weaknesses.

Financing Alignment That Matches the Strategy

Arizona investors now face a wide range of lending options:

- Conventional

- DSCR

- Portfolio lending

- SBA & owner-user financing

- Commercial loans

DTD Realty helps our clients understand key financing terms and alignment with strategy:

- Loan structure matches holding period

- Leverage matches risk tolerance

- Reserves are properly planned

- Rate risk is understood

- Refinance positioning is intentional

Debt should be a tool for growth, not a source of instability.

Long-Term Advisory, Not One-Off Transactions

DTD Realty is built around long-term investor relationships. That means:

- Not every property is “the one”

- Not every year is an acquisition year

- Sometimes the best move is to wait, refinance, or rebalance

- Sometimes the best move is to sell or exchange

- Sometimes the best move is to protect what you already built

We advise across full cycles — not just during buying frenzies.

Seamless Integration With Tax & Wealth Planning

Smart real estate execution requires coordination with:

- CPAs

- Tax strategists

- Attorneys

- Lenders

- Estate planners

DTD Realty works inside that ecosystem to ensure:

- Acquisitions support tax efficiency

- Dispositions align with long-term wealth goals

- 1031 strategies are considered early

- Depreciation planning is not accidental

- Exit timing is not reactive

This transforms real estate from transactions into a cohesive wealth system.

What Makes DTD Realty Different

DTD is not built on:

- High-volume deal churn

- One-size-fits-all investor advice

- Out-of-state speculation models

- Hype-driven acquisition pipelines

It is built on:

- Discipline

- Strategy

- Capital protection

- Long-term investor thinking

- Arizona-specific execution

Final Thought: Smarter Execution Compounds Faster Than Smarter Ideas

Many investors understand the concepts:

- Cash flow

- Appreciation

- Leverage

- Tax benefits

- Portfolio diversification

But only a smaller group executes those concepts consistently, defensively, and with long-term control.

That outcome is never accidental — it is built through:

- Strategy

- Structure

- Local precision

- Risk discipline

- Tax awareness

- And patient execution

That is the role DTD Realty plays for Arizona investors.

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.