If you use financing to purchase investment property—and most Arizona investors do—then cash-on-cash return (CoC) is one of the most important metrics you’ll ever learn. It tells you how hard your actual invested dollars are working for you each year.

If cap rate is the “big picture,” cash-on-cash is the real-world return on the money you actually put in.

This guide breaks it down in simple terms, with clean examples and Arizona context.

What Is Cash-on-Cash Return? (Simple Definition)

Cash-on-cash return (CoC) measures the annual cash flow you earn compared to your total cash invested into the deal.

Cash-on-Cash Return = Annual Cash Flow ÷ Total Cash Invested

Where “total cash invested” normally includes:

- Down payment

- Closing costs

- Upfront repairs or make-ready costs

- Loan fees (including DSCR points if used)

- Initial reserves (optional but recommended)

This metric matters because it identifies the true return on your actual dollars—not the bank’s.

Why Cash-on-Cash Return Matters for Arizona Investors

1. It Reflects Real Investor Performance

Financed deals (DSCR or conventional) often look mediocre on cap rate but strong on cash-on-cash due to leverage.

2. It Helps Compare Very Different Deals

With CoC, you can compare:

- a Phoenix single-family home

- a Tucson duplex

- a Glendale 4-plex

- a Maricopa new build

- a Mesa condo

CoC “equalizes” deals so you can see which one truly works harder for your money.

3. It Helps Identify Over-Leveraged or Underperforming Properties

If cash flow is negative or razor thin, cash-on-cash exposes it immediately.

4. It’s a Key Metric Lenders Look At

DSCR lenders, portfolio lenders, and private lenders all care about CoC indirectly because poor CoC often reflects operational weakness.

What Is a Good Cash-on-Cash Return in Arizona?

This varies by strategy, risk level, and timeframe, but typical ranges for 2024–2025:

- Phoenix SFR: 1–5%

- Phoenix Small Multi (2–4 units): 3–8%

- Tucson SFR/Multi: 5–10%

- Short-Term Rentals: Wide range, 0–20% (high risk/variance)

- Value-Add Projects: Varies, but CoC can grow significantly post-renovation

Remember:

Cash-on-cash return is highly influenced by financing.

Arizona Cash-on-Cash Example: Mesa Single-Family Rental

Example 1: West Phoenix Starter Rental — Low Cash Flow, Strong Cash-on-Cash

Property: 3-bed SFR in Maryvale / West Phoenix

Purchase Price: $325,000

Down Payment (20%): $65,000

Closing Costs: $6,000

Total Cash In: $71,000

Monthly Rent: $2,050

Monthly Expenses (PITI + PM + Maintenance Reserve): $2,000

Monthly Cash Flow: $50 ($600/yr)

By Cash Flow Alone

$600/yr looks “meh” — many new investors would assume this is a bad deal.

But here’s the CoC Return

CoC = $600 / $71,000

CoC = 0.85%

That seems low… until the kicker:

Where CoC Shows Hidden Value

West Phoenix has averaged 4–6% annual appreciation over the last 10 years.

Even using the conservative 3% on a $325,000 property:

Annual appreciation = $9,750

CapEx-adjusted rent growth historically averages 2–3% annually, meaning next year’s cash flow is likely:

$50 → $125 → $200 → $300/month over time

→ this is where CoC becomes meaningful. It highlights that:

- A small cash flow today does not reflect your long-term return

- Your CoC jumps dramatically as rents rise while your initial cash basis stays fixed

Why this matters for investors

This is a classic Phoenix starter rental:

mediocre cash flow day one, but historically strong total return + rent growth.

Cash-on-cash helps investors not dismiss solid long-term winners.

Example 2: Mesa Condo — Near Break-Even Cash Flow, Excellent CoC

Property: 2-bed Mesa condo near Dobson Ranch

Purchase Price: $260,000

Down Payment (25%): $65,000

Closing Costs: $5,000

Initial Repairs: $5,000

Total Cash In: $75,000

Monthly Rent: $1,825

Monthly Expenses (incl. HOA): $1,780

Monthly Cash Flow: $45 ($540/yr)

Cash Flow View

$45/month? Many people stop right there.

Cash-on-Cash View

CoC = $540 / $75,000 → 0.72%

Still modest — but…

The Important Takeaway

Condos in Mesa often have:

- Lower CapEx exposure

- Lower surprise maintenance

- High rentability (students, young professionals, ASU spillover)

- Lower vacancy

This is where CoC helps investors understand that:

A low cash flow property with low operational risk can still be a strategic winner.

The stability of returns is a huge part of the CoC story, and Mesa shines in this category.

Example 3: Tucson Fourplex — High CoC Even Without High Cash Flow

Property: 4-plex near Tucson Medical District

Purchase Price: $625,000

Down Payment (25%): $156,250

Closing Costs: $10,500

Total Cash In: $166,750

Rent per Unit: $1,100

Total Rent: $4,400

Expenses: $4,150

Monthly Cash Flow: $250 ($3,000/yr)

Cash Flow View

$250/mo is good, but not eye-popping for a fourplex.

Cash-on-Cash Return View

CoC = $3,000 / $166,750 = 1.8%

Also not huge — so why is CoC helpful here?

Where CoC Shows Investor Opportunity

Tucson multifamily regularly sees:

- Rent stability near medical + university corridors

- Low vacancy due to constant tenant pipeline

- Higher long-term resiliency vs. single-family

CoC tells beginning investors:

“Even if year-one cash flow doesn’t blow you away, stabilized multifamily offers dependable long-term returns.”

The upside is in stability, turnover control, and appreciation — not massive cash flow day one.

Summary of Arizona CoC Examples

These examples highlight why cash flow alone often paints an incomplete picture.

Arizona markets — Phoenix, Mesa, Tucson — frequently deliver:

- modest year-one cash flow,

- but strong long-term total return,

- offset by rent growth,

- in markets with stable job, population, and demand trends.

Cash-on-cash return helps beginning investors understand that a deal with small cash flow today can be an excellent long-term performer.

As an investor metric, cash-on-cash is especially useful for:

- value-add purchases

- BRRRR projects

- DSCR-financed STRs

- older homes with strong rent upside

- small multis in Tucson or Glendale

- any deal where financing terms matter

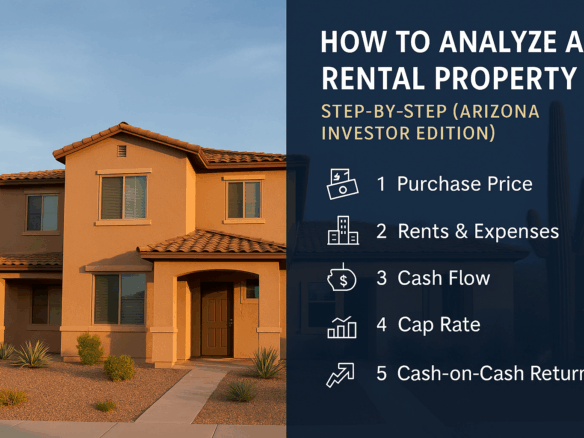

Cash-on-Cash vs. Cap Rate (Know the Difference)

Cap rate measures property performance without financing.

Cash-on-cash measures investor performance with financing.

A deal can have:

- Strong cap rate but weak cash-on-cash (common with expensive renovations)

- Weak cap rate but strong cash-on-cash (common with optimal DSCR financing)

Both metrics matter—but for financed buyers, cash-on-cash tells the truth.

How To Improve Cash-on-Cash Return (Arizona Strategies)

1. Improve Financing Structure

DSCR IO, 40-year amortization, or buying down the rate can transform marginal cash flow.

2. Add Value

Upgrades that justify higher rents can push CoC positive.

3. Buy Small Multis Instead of SFRs

2–4 units often outperform Phoenix SFRs by 3–7% CoC.

4. Target Stronger Price-to-Rent Markets

e.g. Mesa ≫ Scottsdale for cash flow.

5. Avoid High-HOA Communities

They destroy margin.

6. Avoid Over-Renovating

Every dollar you add to your total cash invested reduces CoC unless rents increase proportionally.

How DTD Realty Helps You Maximize CoC

We can help you run full investor analysis including:

- Cash-on-cash modeling

- DSCR pre-underwriting

- Scenario-based financing strategies

- 10-year cash flow projections

- Renovation ROI evaluation

- Deep rent comp analysis

- Zip-by-zip yield mapping throughout Arizona

Your return is not a guess—it’s a model we help you build with precision.

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.

📞 602.702.3601

🌐 https://www.dtdrealty.com

📩 [email protected]