If you’re a newer investor looking to scale in Arizona, the term DSCR loan will come up almost immediately. These loans have exploded in popularity because they allow investors to qualify based on the property’s income, not their personal tax returns.

For investors with self-employment income, multiple rental properties, or complex write-offs, DSCR financing can be a game-changer. They aren’t perfect, but they open doors that traditional lending often closes.

This guide breaks down what DSCR loans are, how they work, and what Arizona investors should know before using them.

What Is a DSCR Loan?

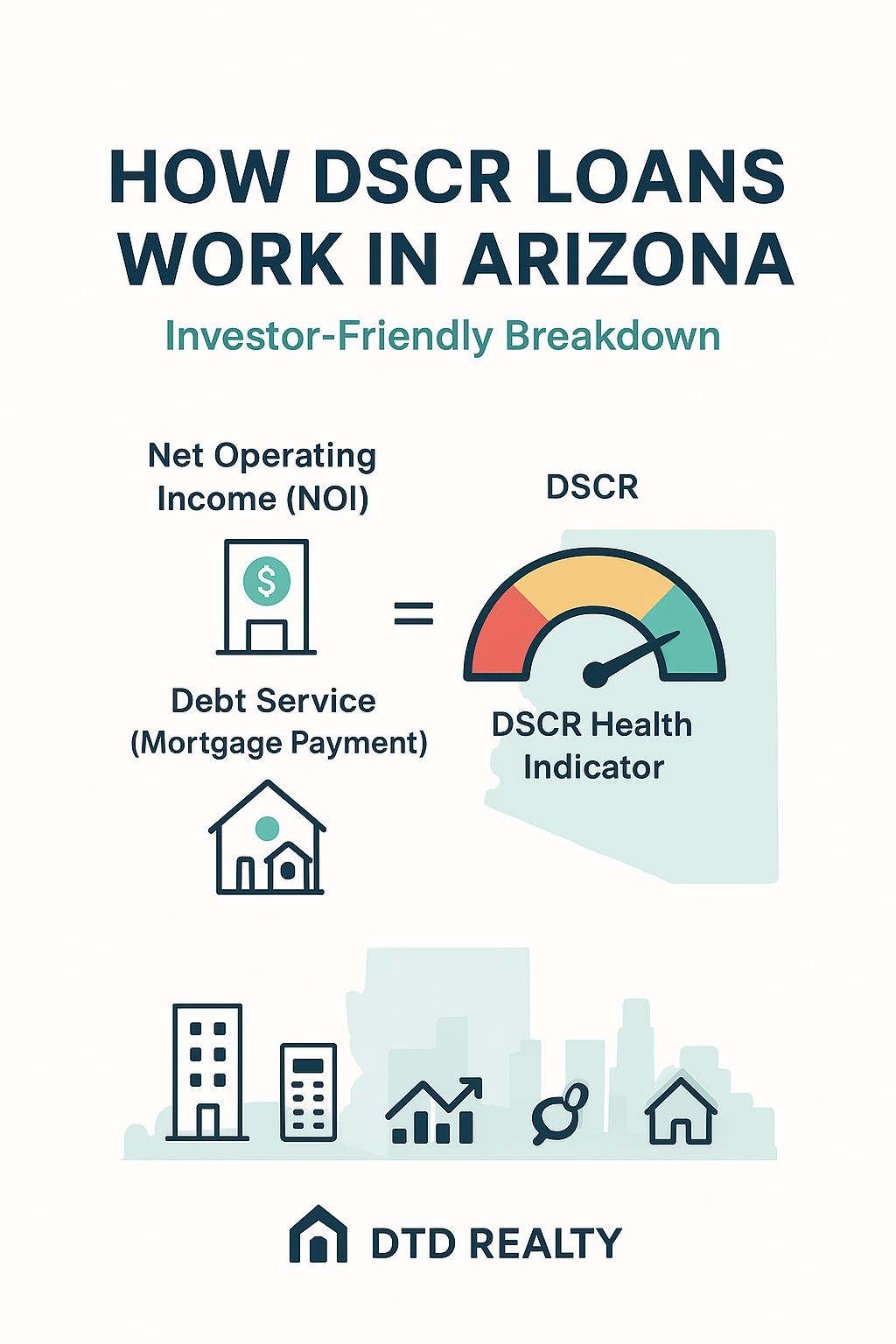

DSCR stands for Debt Service Coverage Ratio, which measures whether the rental income of a property can cover the loan payment.

The formula is simple:

DSCR = Net Operating Income ÷ Annual Debt Service

(NOI divided by the annual principal + interest payment)

Most lenders want a DSCR of 1.00 to 1.25, meaning the property produces enough rent to at least cover the mortgage.

For example:

If a property rents for $2,000/mo and the mortgage payment is $1,800/mo,

DSCR = 2000 / 1800 = 1.11

That’s typically good enough to qualify.

Why Arizona Investors Love DSCR Loans

Arizona’s investment landscape—especially in Phoenix, Mesa, Chandler, and Tucson—pairs very well with DSCR lending because:

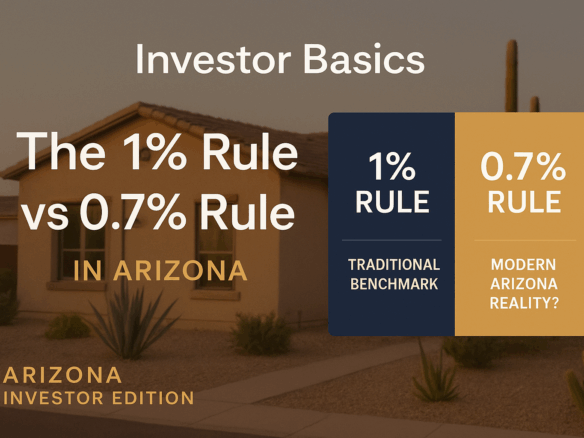

- Rents are strong relative to acquisition prices

- Many investors are self-employed or own multiple properties

- Turnkey rentals are common

- Appraisers are comfortable with investor properties

- Lenders are active here and compete heavily on DSCR products

Even as insurance and taxes have risen, DSCR programs remain flexible and accessible, making them a solid fit for BRRRR strategies, long-term rentals, and mid-term rentals.

How DSCR Loans Work (Simple Version)

1. They qualify the property, not the borrower.

Traditional underwriting focuses on income, tax returns, job history, and DTI. DSCR lenders focus on:

- market rent

- property condition

- DSCR ratio

- valuation

- LTV

2. They use market rents, not your actual lease.

Most lenders rely on the Appraisal Form 1007 Rent Schedule.

So even if you have a higher-paying tenant lined up, the loan is based on market rent.

3. They allow high LTVs.

Most lenders offer:

- 80% LTV for purchases

- 75% LTV for cash-out refinances

4. They close fast.

Because tax returns aren’t reviewed, closings often take 10–21 days depending on appraisal timelines.

Common Uses for DSCR Loans in Arizona

✔ BRRRR Refinances

DSCR loans are extremely popular for BRRRR exits, especially when investors can’t or don’t want to use conventional financing.

✔ Buy-and-Hold Single-Family Rentals

Perfect for newer investors buying their first few rentals in Phoenix or Tucson.

✔ Mid-Term Rentals (Travel Nurses, Tech Consultants)

DSCR lenders typically count these as long-term rentals as long as the rent schedule supports the payment.

✔ Condos and Townhomes (Case-by-Case)

Many lenders won’t do condos under 600 sq ft or litigation-heavy HOAs—but Arizona has many DSCR-friendly communities.

Pros of DSCR Loans

✔ Easier approval

No tax returns, W-2s, or DTI calculations.

✔ Great for self-employed investors

Your business write-offs won’t disqualify you.

✔ Helps you scale faster

You can buy multiple properties in a short period.

✔ Flexible loan structures

Options often include:

- 30-yr fixed

- interest-only periods

- ARMs

- LLC ownership

✔ Works well for BRRRR

Appraisers understand forced appreciation in Arizona’s older neighborhoods.

Cons of DSCR Loans

✘ Higher rates than conventional

Usually 0.75%–1.50% higher depending on credit and DSCR level.

✘ Higher closing costs

Expect lender fees and sometimes prepayment penalties.

✘ Stricter DSCR requirements in softer markets

Some lenders may require 1.10–1.20 DSCR depending on portfolio size.

✘ Not all property types qualify

- manufactured homes

- rural acreage

- heavy fixers …are sometimes excluded.

✘ Short-term rentals are more restrictive

Airbnb/STR DSCR loans exist but often require strong financials and established rent rolls.

What a Typical DSCR Deal Looks Like in Arizona

A typical beginner-friendly DSCR deal might look like:

- Purchase Price (or ARV for BRRRR): $350,000

- Market Rent: $2,200/mo

- PITI: $1,900/mo

- DSCR = 1.16

- 20% down payment (or 75% LTV for BRRRR)

- 30-year fixed DSCR loan

This is a realistic profile for properties in:

- West Phoenix

- Maryvale (careful underwriting)

- Mesa (east side pockets)

- Glendale

- Northern Tucson

Cash flow may be modest, but DSCR loans prioritize scalability, not maximum cash flow.

Tips for Beginners Using DSCR Loans

1. Don’t chase perfect DSCR ratios

A DSCR of 1.10–1.15 will normally qualify.

2. Know your reserves

Many lenders require 6–12 months PITI across your portfolio.

3. Get rent comps early

Order a preliminary rent study or have your agent run realistic rent comps.

4. Shop lenders

DSCR lenders vary significantly in pricing and policy.

Your mortgage broker or investor-focused agent is key here.

5. Use an LLC if appropriate

DSCR loans allow title to be held in an LLC, which could help with liability protection.

6. Avoid over-leveraging

High leverage magnifies risk, especially in markets with rising insurance and taxes.

Is a DSCR Loan Right for You?

A DSCR loan is ideal if you:

- are self-employed

- have multiple rentals

- have write-offs that reduce taxable income

- want to scale quickly

- prefer flexible lender guidelines

But they are not ideal if you:

- rely on maximum monthly cash flow

- are buying in areas with weak rental demand

- want the lowest possible interest rate

- have a very small reserve buffer

Most Arizona investors eventually use DSCR loans—even if they start with conventional financing.

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.

📞 602.702.3601

🌐 https://www.dtdrealty.com

📩 [email protected]