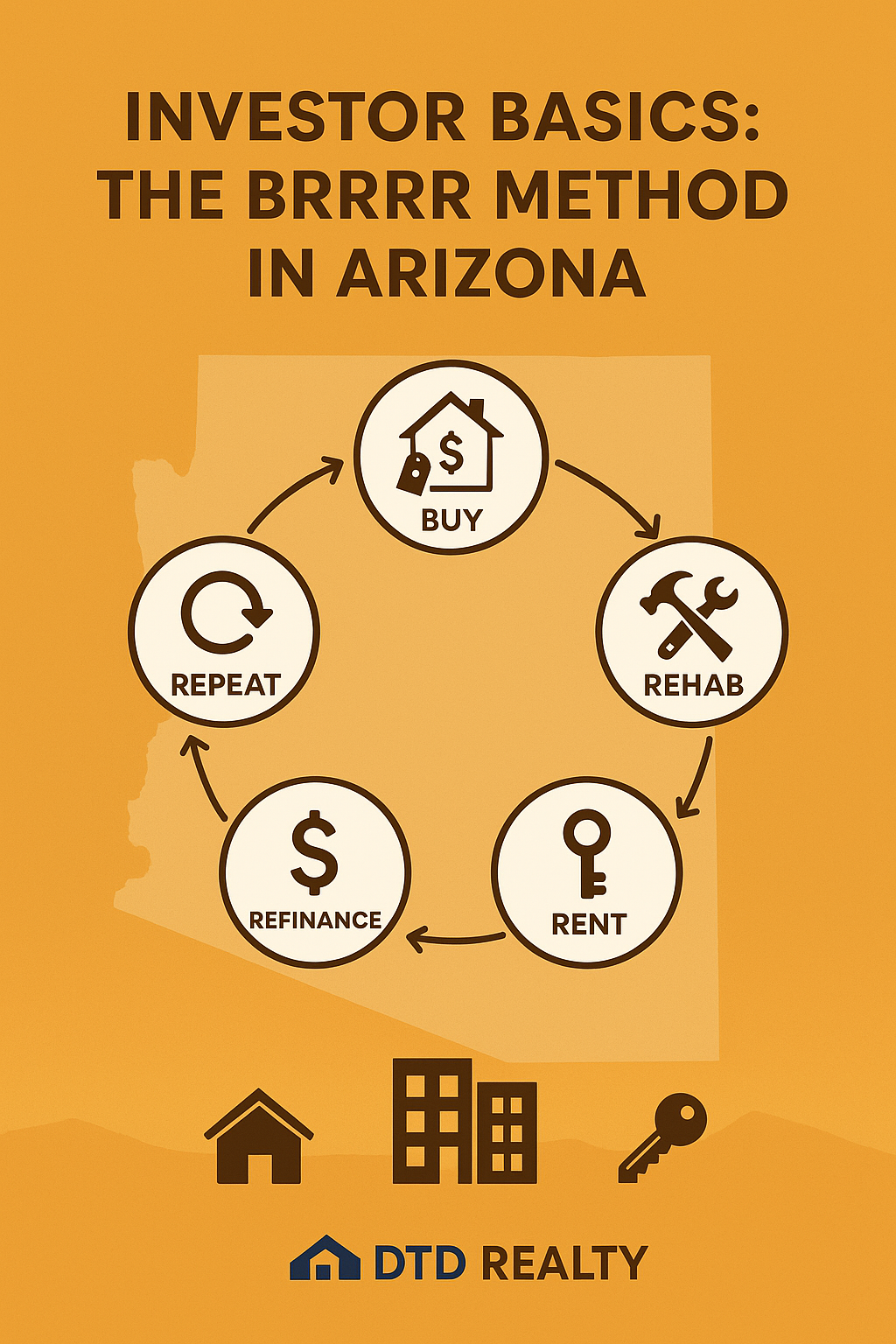

If you talk to any seasoned real estate investor in Arizona, eventually you’ll hear the acronym BRRRR. It stands for Buy, Rehab, Rent, Refinance, Repeat, and it’s one of the most popular strategies for accelerating portfolio growth—especially for investors who don’t have endless capital to deploy.

BRRRR is powerful because it transforms a single down payment into multiple properties over time. It’s not easy, but when executed well, it can fast-track wealth building faster than almost any other residential strategy.

Below is a clear, beginner-friendly breakdown—written for Arizona conditions, lending environments, and property types.

What Is BRRRR? (The Short Version)

BRRRR is a strategy that allows you to:

- Buy an under-market property

- Rehab it to increase its value

- Rent it to stabilize income

- Refinance to pull out your initial capital

- Repeat using the same capital in the next deal

Essentially, you’re forcing appreciation through renovation and then recycling your cash.

Why BRRRR Works So Well in Arizona

Arizona—particularly Greater Phoenix—has long been a BRRRR-friendly market because:

- distressed and outdated homes remain common in older neighborhoods

- demand for rentals is strong (especially near job corridors and ASU)

- rents adjust quickly after renovations

- appraisers value high-quality updates

- lender appetite for DSCR and cash-out loans remains strong

Even with rising insurance and property taxes, BRRRR still works here as long as underwriting is conservative.

Step 1: Buy — The Right Property Matters More Than Anything

Successful BRRRRs start with buying at the right basis. When evaluating deals in Arizona:

Look for:

- cosmetically outdated but structurally sound homes

- properties with ≤20 years deferred maintenance

- neighborhoods with rising rental demand

- homes where a $30–$60k rehab meaningfully boosts ARV

Avoid:

- major foundation issues

- polybutylene plumbing

- unpermitted additions

- flood zones (insurance!)

- HOAs with restrictive rental rules

The deal is made on the buy, not the refinance.

Step 2: Rehab — Force Appreciation With Smart, Affordable Upgrades

The goal is to raise the ARV (After Repair Value) enough that the refinance returns most or all of your original cash.

In Arizona, the highest-ROI upgrades include:

- new LVP flooring

- fresh interior paint

- modern kitchen with shaker cabinets & quartz

- updated bathrooms

- new roof only if needed (big value bump in AZ)

- HVAC replacement (high ROI due to heat)

- low-maintenance desert landscaping

Avoid over-customization, and stick to durable, rental-grade finishes.

Step 3: Rent — Stabilize the Property Quickly

A solid tenant improves:

- refinance terms

- DSCR ratios

- appraiser confidence

- cash flow consistency

For Arizona BRRRRs, investors often succeed by targeting:

- families looking for 3/2s

- students near ASU/Tempe

- remote workers moving to Phoenix

- traveling nurses (for mid-term rentals)

Pro tip:

Consider offering small incentives to fill the unit quickly—first month at a discount, upgraded appliances, or free professional cleaning.

Step 4: Refinance — Where the BRRRR Magic Happens

Once the property is stabilized (usually after 3–6 months), you refinance to pull out equity.

Types of refinances commonly used in Arizona:

- Conventional cash-out refi (if you qualify personally)

- DSCR loans (popular with BRRRR investors)

- Portfolio lender refi (easier on documentation)

- Credit union refi (often better rates)

Your goal:

Extract as much of your original down payment and rehab money as possible, while still cash-flowing.

Typical BRRRR metrics investors aim for:

- 70–75% LTV on refinance

- cash-out covering 80–100% of initial cash

- stabilized DSCR ≥ 1.15–1.25

- cash flow after all expenses

- long-term reserves funded

Step 5: Repeat — Turn One Investment Into a Portfolio

Once capital returns to you, you rinse and repeat:

- buy another distressed property

- apply the same process

- scale from 1 to 5 to 10+ rentals

This is how many Arizona investors built multi-million-dollar portfolios on modest starting capital.

Common Mistakes for First-Time BRRRR Investors

1. Overestimating ARV

Appraisals in Arizona can be conservative—especially in older subdivisions.

Use real comps within ¼ mile.

2. Underestimating rehab timelines

Contractor delays are extremely common.

Pad your timeline by 20–30%.

3. Assuming rents will be higher than market

Use actual comps, not Zillow dreams.

4. Ignoring rising taxes & insurance

These two expenses increased meaningfully in 2024–2025.

5. Choosing bad locations for long-term holds

Cheap properties are not always good investments.

Is BRRRR Still Worth It

Yes—but the math is tighter than it was five years ago.

BRRRR still works in Arizona when:

- the buy price is favorable

- the rehab is efficient

- the rental demand is strong

- the refinance is conservative

- the investor has solid reserves

If you execute poorly, BRRRR becomes stressful and expensive.

If you execute well, it’s one of the fastest paths to financial independence.

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.

📞 602.702.3601

🌐 https://www.dtdrealty.com

📩 [email protected]