For new investors, house hacking is one of the simplest, safest, and smartest ways to build wealth through real estate. It’s the strategy that has launched thousands of investor careers nationwide—and it works especially well in Arizona, where rising rents, strong job growth, and a flexible lending environment create ideal conditions for beginner investors.

This guide breaks down what house hacking is, how it works, and how to decide whether it’s the right move for your first step into Arizona real estate investing.

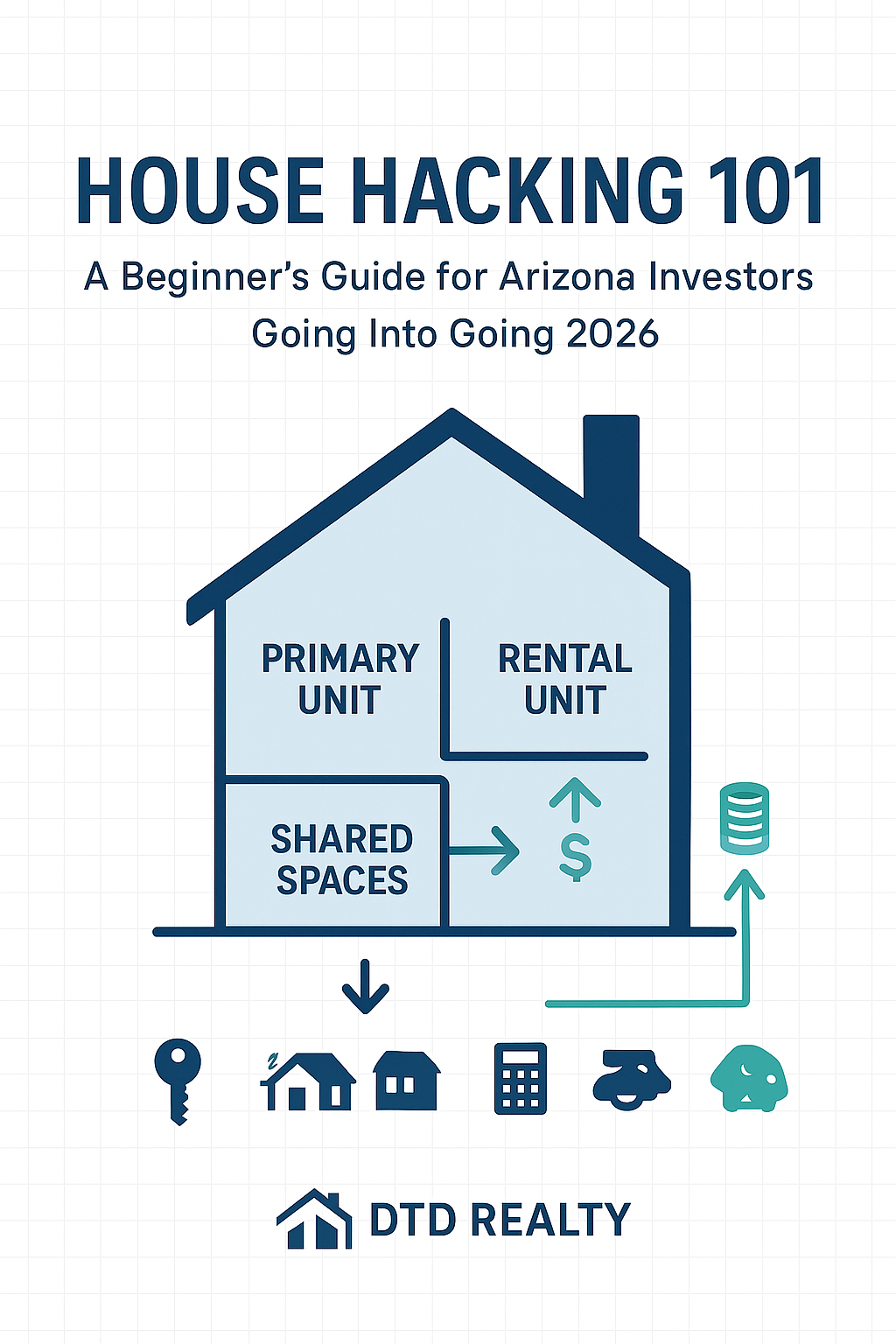

What Is House Hacking?

House hacking is the strategy of living in one part of a property while renting out the other parts to reduce (or even eliminate) your housing payment.

That can mean:

- Living in one unit of a duplex, triplex, or fourplex

- Renting extra bedrooms in a single-family home

- Creating a connected or detached guest suite and renting it long-term

- Using a casita, basement, or converted space as rental income

- Renting to a roommate or two to slash your monthly costs

The end goal is simple:

Reduce your cost of living → redirect those savings into future investments → grow your portfolio.

Why House Hacking Works So Well in Arizona

Arizona—especially the Phoenix metro—has several built-in advantages:

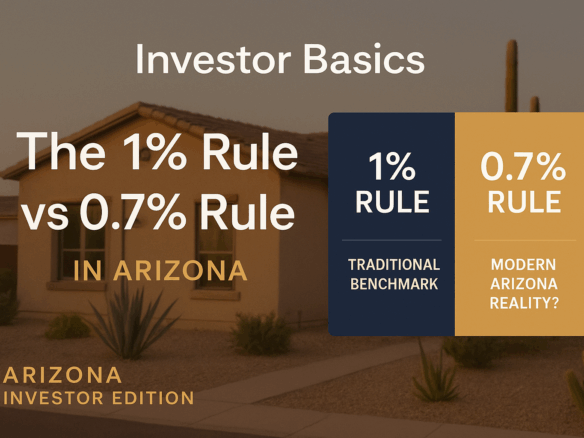

1. High Rent-to-Price Ratios (Compared to Other Western States)

Phoenix, Mesa, Glendale, Chandler, and Tempe often support rents that help offset a significant portion of a mortgage, even at today’s interest rates.

2. Strong Demand for Rental Units & Rooms

Job growth + universities + relocations keep demand high for:

- rooms

- small units

- guest suites

- casitas

- duplex/triplex/fourplex rentals

3. Favorable Owner-Occupant Loan Options

House hackers can use low-down-payment loans like:

- FHA (3.5% down)

- Conventional 3–5% down

- VA (0% down)

- USDA (0% down in eligible rural AZ areas)

These loans allow you to buy multi-units with far less cash than an investor loan.

4. Ability to “Step Up” to Future Investments

After living in the property for a year (typical lender requirement), many house hackers move to the next home and keep the first as a permanent rental.

This helps new investors scale a portfolio faster with less capital.

Three Arizona-Friendly House Hacking Strategies

Strategy 1: The Multi-Family Hack (Best for Long-Term Wealth)

Buy a duplex, triplex, or fourplex. Live in one unit, rent the other(s).

Example:

- 4-plex in West Phoenix or Glendale

- You live in a 1-bed

- The other 3 units generate steady rent

- You use FHA or Conventional financing

- After 12 months → move to the next property and retain the 4-plex

This strategy builds the strongest long-term equity.

Strategy 2: The Extra-Bedroom Hack (Low Cost, High ROI)

You buy a single-family home and rent out individual bedrooms.

Works extremely well in:

- Tempe (ASU)

- Mesa (EVIT, MCC)

- Phoenix near major employers

- Glendale (ASU West)

This is the lowest-friction way to start investing.

Strategy 3: The Casita / Guest Suite Hack (Arizona Special)

Arizona has more casitas, guest houses, and converted garages than most states.

Renting these units is a great way to reduce your mortgage without sacrificing privacy.

Examples:

- North Phoenix casita

- Mesa guest suite with private entrance

- Queen Creek basement suite

- Surprise or Buckeye detached studio

This is extremely popular with traveling nurses, remote workers, and long-term month-to-month tenants.

How to Analyze a House Hack (Beginner-Friendly)

1. Estimate Your Monthly Payment

Include:

- principal & interest

- taxes

- insurance (and elevated AZ premiums in 2024–25)

- HOA (if applicable)

- utility costs

2. Estimate Rent from the Portion You’ll Rent Out

Look at:

- room rents

- casita rents

- unit rents

- rent comps in the neighborhood

3. Calculate Your “Net Housing Cost”

Mortgage payment – rental income = Your new out-of-pocket cost

Goal:

Reduce your housing cost by 50–100%.

Anything below your current rent is a win.

Realistic Arizona Examples

Example 1: Glendale 4-Plex Hack

- Total Mortgage Payment: $3,900/mo

- Rents From Other 3 Units: $3,600/mo

- Your Net Housing Cost: $300/mo

Example 2: Tempe Room-Rental Hack

- Mortgage Payment: $2,700/mo

- Two Rooms Rented: $1,500 + $1,450 = $2,950/mo

- Your Net Housing Cost: –$250/mo (you live for free and profit)

Example 3: Queen Creek Guest Suite Hack

- Mortgage: $2,400/mo

- Guest Suite Rent: $1,350/mo

- Your Net Housing Cost: $1,050/mo

- Much lower than renting a comparable full home.

Common Concerns (And the Real Answers)

“I don’t want roommates.”

Then use the guest-suite or casita strategy for more privacy.

“I don’t want to manage tenants.”

House hacking tenants tend to be:

- stable

- predictable

- easy to manage

And when you’re on-site, small issues stay small.

“Is it safe to rent rooms?”

Require:

- background checks

- written leases

- deposits

- clear house rules (quiet hours, parking, utilities, etc.)

“Would my property appreciate?”

Arizona’s fundamentals—population growth, job expansion, climate migration—continue to support long-term appreciation.

Why House Hacking Is the Best First Step for New Investors

Because it solves the two biggest barriers to investing:

1. Down Payment

You can use owner-occupant loans with low down payments.

2. Monthly Affordability

Rental income dramatically reduces or even eliminates your housing expense.

Result:

You save cash faster, build equity earlier, and position yourself for future acquisitions.

House hacking is the fastest, safest on-ramp to becoming a long-term Arizona real estate investor.

Final Thoughts

House hacking isn’t just a strategy; it’s a launchpad.

For beginners in Arizona—especially in a market where affordability is tight and operating costs are rising—it’s one of the most powerful ways to get started.

The key is choosing the right property, in the right submarket, with the right rental potential.

If you want help identifying viable house-hack properties in Phoenix, Mesa, Tempe, Gilbert, Chandler, or Queen Creek, DTD Realty can guide you through each step.

Check out our full guide: Arizona Real Estate Investing Guide – From First Deal to Scalable Portfolio

DTD Realty — Do The Deal.

Driven. Trusted. Dependable.

📞 602.702.3601

🌐 https://www.dtdrealty.com

📩 [email protected]